Advertisement|Remove ads.

BEML Shares Show Potential Monthly Reversal: SEBI RA Sameer Pande Sees Sideways To Positive Trend

BEML is showing encouraging technical signals suggesting a potential reversal on the monthly chart, according to SEBI-registered analyst Sameer Pande.

At the time of writing, BEML shares were trading at ₹4,293.30, up 0.32% or ₹13.60 on the day

According to Pande, the stock has formed a strong supply zone near the ₹4,550 level, which could be a significant resistance point in the near term.

On the downside, there is a robust demand zone around ₹3,300 to ₹3,200, providing crucial support to the stock and helping to limit further downside risk.

Pande expects the stock to trade sideways to a slightly positive pattern over the coming sessions, driven by multiple supply zones visible in the weekly timeframe.

These zones indicate areas where selling pressure may increase, highlighting potential consolidation phases that can stabilize the price.

The analyst’s technical view aligns with BEML’s recent fundamental performance.

For Q4, the company posted a 12% year-on-year rise in consolidated net profit to ₹287.55 crore. Revenue also grew 9% year-on-year to ₹1,652.53 crore.

While BEML announced a second interim dividend of ₹15 per share, the final declaration has been postponed.

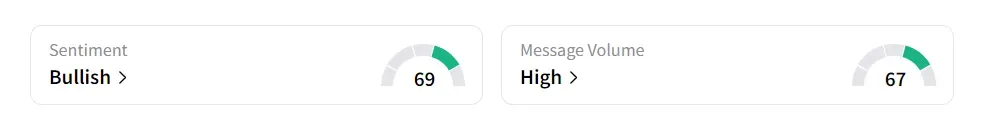

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

The stock has risen 4.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)