Advertisement|Remove ads.

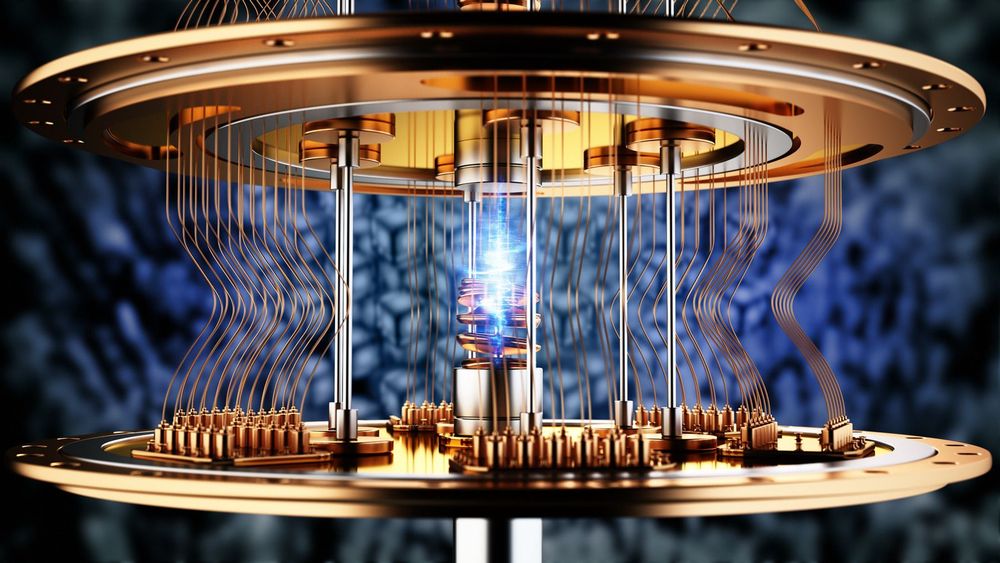

IONQ, QBTS, RGTI: Retail Traders Gear Up For ‘Explosive’ Moves As Trump Administration Reportedly Mulls Quantum Investments

- Quantum computing companies are reportedly lobbying the U.S. government to secure about $10 million each.

- Deputy Commerce Secretary Paul Dabbar, a former quantum computing executive, has been leading the funding discussions with the companies.

- These stocks were among the top-trending equity tickers on Stocktwits early Thursday.

Quantum computing stocks are likely to garner significant investor interest after Wednesday’s sharp plunge amid a broader market decline. Shares of these companies rebounded sharply in overnight trading, following a media report about President Donald Trump’s administration potentially investing in the industry.

The Defiance Quantum ETF (QTUM), which tracks the liquid companies in the global quantum computing and machine learning industries, climbed 3% in overnight trading, according to Yahoo Finance. It fell 2.70% on Wednesday.

Trump Prop Comes Calling?

A Wall Street Journal report, citing people familiar with the matter, stated that publicly-listed quantum computing companies such as Rigetti Computing (RGTI), IonQ (IONQ), D-Wave (QBTS), and Quantum Computing (QUBT) have had talks with the Commerce Department to give the government equity stakes as a quid pro quo for federal funding. The report also flagged privately-held Atom Computing as among those mulling taking in the government as a shareholder.

The companies are lobbying to secure about $10 million each. The rumored development aligns with the Trump administration's thinking that the government should benefit from the success of companies it supports with taxpayer money.

Washington has recently acquired a 10% stake in struggling Intel Corp., which has benefited from the financing extended through the CHIPS Act. The government has also taken part ownership in companies operating in strategically important industries such as rare earths, one that has been at the core of the ongoing U.S.-China trade tensions.

The funding would reportedly be routed through the Commerce Department’s Chips Research and Development Office. According to the Journal, Deputy Commerce Secretary Paul Dabbar, a former quantum computing executive, has been leading the funding discussions with the companies. Bohr Quantum, a company Dabbar co-founded, is not among the companies in the running to secure government funding, it added.

Reacting to the news, Quantum Computing Inc. CEO Yuping Huang told WSJ that the prospect of potential government investment is “exciting.” A Rigetti spokeswoman said the company has been continuously engaging with the government on funding opportunities. D-Wave’s Head of Government Relations Allison Schawrtz pointed out that the company wants to sell its systems to the government to help it solve complex problems and seeks to get a return on its investment.

Quantum Stocks Jump, Retail Position For More Gains

The following stocks moved in the overnight trading in reaction to the report:

Rigetti: +15.6%

D-Wave: +16.3%

Quantum Computing: +12.8%

IonQ: +14.7%

SEALSQ: +15%

Companies in this sector are also drawing the attention of “smart money”. Churchill Capital, a special-purpose acquisition company (SPAC), has agreed to merge with quantum computing company Infleqtion.

Quantum computing stocks were among the top-trending equity tickers on Stocktwits early Thursday. Sentiment toward RGTI improved a tad from depressed levels to ‘bearish.’ At the same time, shares of D-Wave, Quantum Computing, IonQ, SEALSQ, and Churchill Capital have triggered ‘bullish’ reactions on the platform.

A bullish user predicted that all quantum computing stocks will see explosive moves on Thursday.

Quantum Computing — Next Tech Frontier?

While the quantum computing industry is in its nascent stage of development, analysts and strategists see the technology holding much promise. The technology expedites computational processes, potentially helping the development of new drugs, materials, chemicals, and other products.

Aside from startups, big techs such as IBM, Alphabet’s Google, and Microsoft have also made significant inroads into the arena.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Lam Research Stock Wobbles After-Hours Despite Q1 Beat: Here’s Why

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)