Advertisement|Remove ads.

General Motors In Spotlight After Bernstein Downgrades Stock, Cuts Price Target To $35 – Retail Sentiment Dips Further

Shares of automaker General Motors Co. (GM) traded nearly 5% lower in premarket on Monday after analysts at Bernstein downgraded it to ‘Underperform’ from ‘Market Perform,’ and in the wake of the broader markets decline over uncertainty surrounding the Trump administration’s tariff policies.

The investment firm also cut GM’s price target to $35 from $50 in light of the imposition of 25% auto tariffs by the current administration.

The tariffs, applicable on vehicles imported into the U.S., became effective last week. Tariffs on auto parts are expected to follow in a month.

As tariff pressures intensify and consumer sentiment weakens, GM shares will remain under pressure, Bernstein said, according to TheFly.

The brokerage also updated its forecast for GM, noting a more than 20% reduction in free cash flow and a decrease of over 50% in 2026 adjusted earnings.

“With tariffs, we anticipate GM will lower guidance and try to conserve cash. We expect earnings to decline through the next quarters until Q2 2026, when mitigation efforts and improving consumer sentiment may help GM and the sector to start recovering,” the brokerage said, as reported by CNBC.

GM’s new price target of $35 implies a 21% decline from the stock’s closing price of $44.18 on Friday.

The downgrade follows the company's reporting a 16.7% rise in vehicle deliveries in the U.S. in the first quarter.

GM reported 693,363 vehicle deliveries in the country through the end of March, with Chevrolet-brand vehicles accounting for a whopping majority of them, followed by GMC.

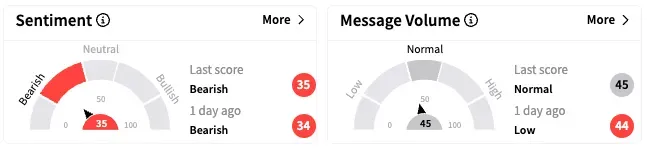

On Stocktwits, retail sentiment around GM dropped further in the ‘bearish’ territory (35/100) while message volume rose from ‘low’ to ‘normal’ levels over the past 24 hours.

GM shares are down by 14% this year and by about 0.4% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)