Advertisement|Remove ads.

Beyond Shares Jump After Strong Q2 Print, Signaling Revival

Beyond, Inc. (BYON) shares jumped 16% in after-hours trading Monday before paring gains to settle at 1% higher, following second-quarter results that handily beat Wall Street expectations.

The e-commerce holding company's revenue fell 29.1% to $282.25 million, but came in higher than analysts' estimate of $250.23 million from LSEG/Reuters.

Adjusted loss per share narrowed to $0.22 per share from a $0.93 per share loss a year ago. The figure came in better than the expected loss of $0.38 per share.

Beyond, formerly Overstock.com, owns and operates a portfolio of online retail brands such as Overstock, Bed Bath & Beyond, and buybuy BABY, as well as blockchain-related businesses.

"Our second quarter results reflect substantial progress in stabilizing our business and delivering improved profitability. This gives me confidence in our ability to move from transformational efforts into executing growth initiatives," CFO Adrianne Lee said in a statement.

In recent years, Beyond has relaunched Overstock, and revived the Bed Bath & Beyond and Buy Buy Baby brands. It has also made efforts to grow its blockchain platform, tZERO.

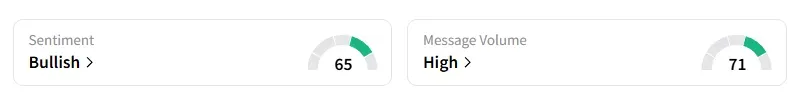

On Stocktwits, the retail sentiment for the company’s shares shifted from ‘bullish’ to ‘extremely bullish’ as of early Tuesday. BYON shares have more than doubled since the start of the year.

The stock surged 22% intraday last week after CEO Marcus Lemonis urged the company's board to explore spinning off and publicly listing tZERO.

Founded within Overstock in 2014, tZERO is a trading platform for securities, such as equities and bonds, as well as, more recently, crypto tokens related to the company's intellectual property.

It operates as an SEC-registered Alternative Trading System (ATS) and is exploring the tokenization of real-world assets, such as real estate and sports team ownership, into tradable securities.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)