Advertisement|Remove ads.

Bharat Electronics: SEBI RA Rohit Mehta Sees Bullish Technical Setup Ahead Of Q1 Earnings

Indian defense contractor Bharat Electronics (BEL) is likely to post substantial year-over-year gains in quarterly revenue and net profit, although sequential numbers are likely to decline.

According to reports, the state-run company is expected to report a 10% increase in revenue to ₹4,244 crore and a 15% rise in net profit to ₹925 crore.

However, revenue could see a 53% fall, sequentially.

Ahead of the first quarter results later in the day, SEBI-registered analyst Rohit Mehta evaluated the stock’s technical structure and the potential implications of the earnings.

BEL stock has seen a strong rally recently, triggered by a cup-and-handle breakout in May and June. The ₹330 - ₹340 range, previously a resistance zone, has now become a critical support level. If the stock holds above this base, the bullish structure remains intact ahead of its Q1FY26 earnings, the analyst said.

At the time of writing, BEL shares were trading 0.5% lower at ₹393.55, around 10% below their all-time high of ₹436.

Fundamentally, the company appears in a position of strength. It remains virtually debt-free, with a 5-year profit CAGR of 23.9% and a 3-year average ROE of 26.5%. It has also provided a consistent dividend payout of 39.1%.

However, the stock’s premium valuation, trading at 14.5x book, and rising working capital days may require monitoring for signs of strain, the analyst noted.

Financially, the company has experienced sharp growth, both on a YoY and sequential basis, in Q4FY25. Sales rose 6.84% YoY and surged 58.54% QoQ, while operating profit grew 23.13% YoY and shot up 68.72% QoQ. EPS followed suit with a 62.57% sequential growth.

The financial performance, as well as the order book, has whetted the appetite of foreign investors, with FIIs increasing their stake from 17.55% to 18.56%. Promoter holding remained steady, while domestic institutional investors (DIIs) marginally reduced their exposure.

Bharat Electronics has experienced strong buying demand lately, gaining nearly 50% over the last six months and 34% year-to-date (YTD).

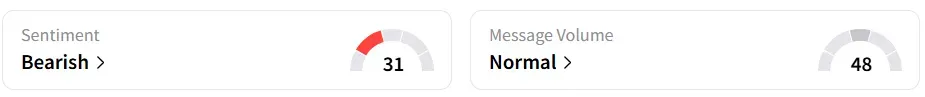

Retail sentiment on Stocktwits turned ‘bearish’ from ‘bullish’ a week earlier, likely due to profit booking after the strong mid-year rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)