Advertisement|Remove ads.

BigBear.ai Stock Slides Ahead Of Q4 Earnings, All Eyes On Potential Impact Of Defense Budget Cut – Retail Remains Bearish

BigBear.ai (BBAI) shares fell as much as 3% on Wednesday afternoon, ahead of the company’s fourth-quarter earnings release after the closing bell on Thursday.

The stock has been trending downwards since the Trump administration directed the Department of Defense (DOD) to cut $50 billion in spending – about 6% of the total defense budget – dampening retail sentiment.

The move raises concerns for defense contractors like BigBear.ai, which relies heavily on government contracts.

Wall Street expects the company to report a loss of $0.05 per share on revenue of $54.61 million, according to Koyfin data.

The AI solutions provider has struggled with profitability, posting operating losses for the past three quarters.

In the third quarter (Q3), the company’s revenue increased 22% year over year to $41.5 million, and gross margins improved to 25.9% from 24.7%.

However, its net losses widened to $149 million, up from $38 million in the same period last year.

BigBear.ai recently restructured its debt, exchanging existing convertible notes for new ones with later maturity dates, easing immediate financial pressure.

At the end of the last quarter, the company's cash balance was $65.6 million, bolstered by $54 million raised through warrant exercises earlier in the year.

The company also secured a contract with the DOD for its Virtual Anticipation Network (VANE), an AI-powered system designed to predict and counter adversarial actions. The deal helped boost the stock in recent weeks.

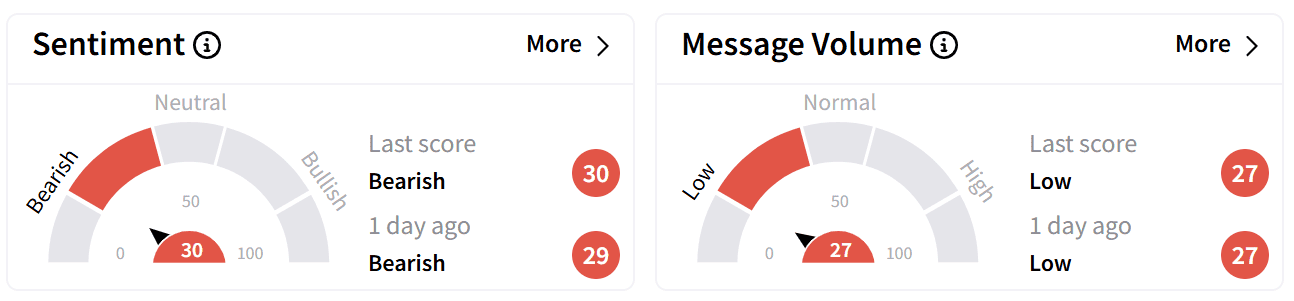

Retail sentiment on Stocktwits around BigBear.ai’s stock remained in the ‘bearish’ zone as traders remained skeptical.

However, one user suggested the company could see a revenue surge in 2025 due to its multi-year defense contracts.

Meanwhile, another forecasted that profitability is within reach for the company.

The stock has lost over half its value since hitting a two-year high of $10.36 in February.

Analysts remain divided on the stock. Three of the five firms give it a ‘Buy'-equivalent rating, while two maintain a ‘Hold’ stance.

The average price target of $4.75 suggests a potential upside of 4.7% from current levels.

With earnings due after Thursday’s market close, investors will be closely watching for updates on government contracts, profitability prospects, and the broader impact of defense budget cuts on BigBear.ai’s business.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)