Advertisement|Remove ads.

Broadcom Holds Steady Ahead Of Q4 Results As AI Boom Meets Tariff Concerns – Retail Bets On Post-Earnings Rally

Broadcom (AVGO) shares stayed flat on Wednesday as investors awaited the company’s fourth-quarter earnings, set for release after the closing bell on Thursday.

Wall Street expects the semiconductor giant to report earnings of $1.51 per share on revenue of $14.5 billion, according to Koyfin data.

Despite recent losses in chip stocks, analysts remain overwhelmingly bullish on Broadcom, with 36 out of 41 covering the stock assigning it a ‘Buy’-equivalent rating.

The average price target of $190.30 suggests a potential upside of 29.6% from current levels.

The results come at a volatile time for semiconductor and artificial intelligence stocks, which have recently faced renewed selling pressure.

Concerns over tariffs and AI chip export restrictions imposed by the Trump administration have weighed on the sector, triggering a broader pullback.

Beyond earnings, investors will closely watch for updates on reports that Broadcom is testing its chips on Intel’s 18-A manufacturing process.

If confirmed, the development could signal a shift in chip production strategies at a time when the U.S. government is pushing to strengthen domestic semiconductor manufacturing.

It was also reported that Broadcom has informally been discussing making a bid for Intel’s chip design and marketing business.

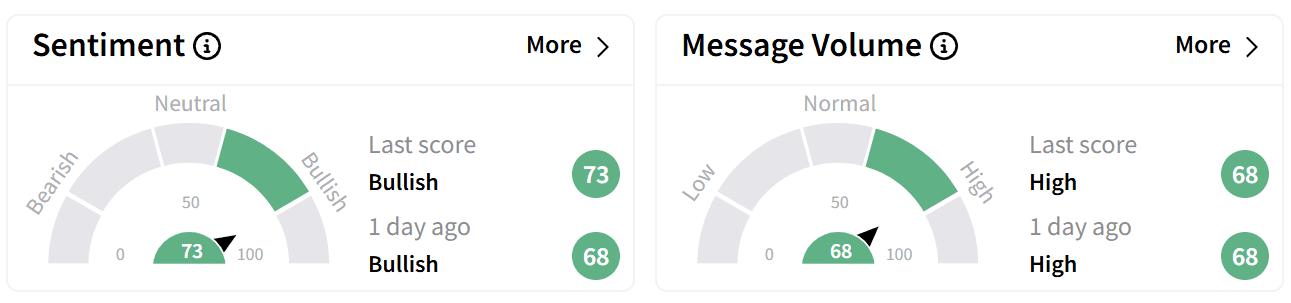

On Stocktwits, retail sentiment around Broadcom’s stock moved higher into the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

One user speculated that Broadcom could return to $220 following earnings, while another argued the stock is undervalued and poised for a post-earnings rally.

Investors will also be listening for commentary on the impact of the Trump administration's tariffs against China on Broadcom’s business.

Broadcom shares have dropped nearly 20% in 2024, shedding roughly a quarter of their market capitalization since hitting an all-time high in December, when it also topped $1 trillion in market value for the first time.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)