Advertisement|Remove ads.

Bill Ackman’s Hedge Fund Backs Howard Hughes $2.1 Billion Vantage Bid

- Howard Hughes announced that it is acquiring specialty insurance company Vantage Group for about $2.1 billion.

- Pershing’s Board, led by Bill Ackman, believes that the Vantage acquisition offers attractive prospects for Howard Hughes.

- The acquisition of Vantage is expected to be completed in the second quarter of 2026.

Pershing Square Holdings announced on Thursday that it will invest up to $1 billion in Howard Hughes Holdings Inc. (HHH) to back the firm’s purchase of Vantage Group Holdings.

Earlier, Howard Hughes announced its purchase of Vantage Group, a specialty insurance company, for about $2.1 billion.

Shares of HHH rose over 2% in Thursday’s premarket sessions.

Deal Contours

Pershing Square, led by billionaire Bill Ackman, will purchase non-voting perpetual preferred shares in Howard Hughes as part of the deal, the company said. The funds from the purchase will be used to finance part of the Vantage acquisition, with the rest coming from Howard Hughes’ cash on hand.

Pershing Square’s Board believes that the Vantage acquisition “offers attractive prospects” for Howard Hughes and thereby for Pershing, which is the real estate company’s largest shareholder, owning 46.9% of the company together with other Pershing Square funds. The Vantage acquisition is expected to close in the second quarter (Q2) of 2026.

The PSH preferred will be split into 14 equally sized tranches, with HHH having the right to repurchase any tranche during a prescribed window after the end of each of the first seven fiscal years following the closing of the Vantage acquisition. “The PSH Preferred will become exchangeable into the common stock of Vantage if not fully repurchased within 60 days following the end of the seventh fiscal year post-issuance,” the firm stated.

“The acquisition of Vantage is a milestone event in the transformation of Howard Hughes into a diversified holding company,” said Bill Ackman, CEO of Pershing Square and Executive Chairman of Howard Hughes.

“The combination of Vantage’s insurance expertise and Pershing Square’s investment capabilities creates the opportunity to build a large, highly profitable insurance company and an important source of long-term value creation for Howard Hughes,” he added.

How Did Stocktwits Users React?

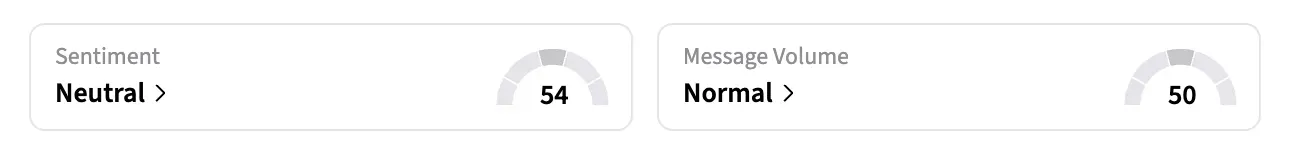

On Stocktwits, the retail sentiment around HHH remained at ‘neutral’ levels over the past day, and message volume stayed at ‘normal’ levels.

Shares of HHH are up over 9% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)