Advertisement|Remove ads.

BioCryst Pharma Stock Soars 10% Pre-Market On Upbeat Q1 Earnings, Improved Full Year Guidance: Retail’s Pleased

Shares of BioCryst Pharmaceuticals, Inc. (BCRX) soared 10% in pre-market trading on Monday after the company raised its full-year guidance and reported first quarter (Q1) earnings above Wall Street expectations.

The firm reported total revenue of $145.5 million, compared to $92.8 million in the first quarter of 2024, owing to an increase in revenue from Orladeyo. The Q1 revenue beat an analyst estimate of $127.79 million, as per Finchat data.

Orladeyo is a prescription medicine used to prevent attacks of hereditary angioedema (HAE), a rare, genetic condition causing recurrent episodes of swelling in various parts of the body, in adults and children 12 years of age and older.

Orladeyo's net revenue in the first quarter of 2025 was $134.2 million, a 51% jump from the previous year.

Net income for the first quarter was $32,000 or $0 per share, compared to a net loss of $35.4 million, or $0.17 per share, for the first quarter of 2024. Analysts expected the company to report a loss of $0.05 per share.

CEO Jon Stonehouse said the company started the year with “outstanding performance.”

“ORLADEYO revenue growth was driven by moving ORLADEYO patients from free drug to paid at a much faster rate than we expected, resulting in a substantial increase to our annual guidance as we also move closer to peak sales of $1 billion,” he said.

“This increased financial strength accelerates our path to profitability and enables us to start paying down our debt, while continuing to invest in and advance our pipeline,” he said.

The company has already submitted a new drug application (NDA) to the U.S. Food and Drug Administration (FDA) to expand the Orladeyo label to children with HAE aged 2 to 11 using an oral granule formulation.

The company also increased its full-year outlook. It now expects global net Orladeyo revenue to be between $580 million and $600 million for the full year, up from its previous guidance of between $535 million and $550 million.

The company also expects to deliver net income and positive cash flows for the full year 2025, earlier than its previous outlook for achieving it in 2026.

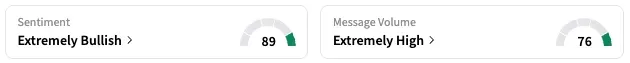

On Stocktwits, retail sentiment around BCRX jumped into the ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

BCRX stock has risen by over 14% this year and by about 69% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)