Advertisement|Remove ads.

BioCryst To Sell European Business Of Its Hereditary Angioedema Drug To Pay Off Debt: Stock Rises While Retail Stays Bearish

BioCryst Pharmaceuticals, Inc. (BCRX) on Friday said that it has entered into a definitive agreement to sell its European Orladeyo business to Italian pharmaceutical company Neopharmed Gentili for up to $264 million.

BCRX shares were up by over 4% in the pre-market session, following the news.

As per the terms of the agreement, Neopharmed Gentili will pay BioCryst $250 million upfront for the European assets and rights related to Orladeyo. Biocryst is also eligible to receive up to $14 million in future milestone payments.

Orladeyo, also known as berotralstat, is a prescription medicine used to prevent attacks of hereditary angioedema (HAE) in adults and children 12 years of age and older. Hereditary angioedema (HAE) is a rare genetic disorder causing recurring episodes of severe swelling in various body parts, including the limbs, face, intestinal tract, and airway.

BioCryst plans to use the proceeds from the transaction to retire all remaining term debt of $249 million from Pharmakon, which will eliminate approximately $70 million of future interest payments.

The biotech company expects the transaction to result in at least $50 million in expected annual operating expense savings for BioCryst. It also expects to end 2027 with approximately $700 million in cash and no term debt, marking an increase of $400 million from its previous 2027 net cash guidance.

In the first quarter (Q1) of 2025, BioCryst reported Orladeyo net revenue of $134.2 million, marking a growth of 51% year-on-year. Oraledyo revenue, in fact, accounted for about 92% of the company’s overall revenue in the period.

However, sales from the U.S. contributed 89.5% of global Orladeyo net revenues in the first quarter, implying the European business accounted for only a small portion.

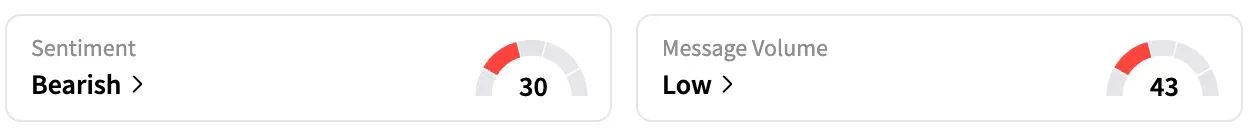

On Stocktwits, retail sentiment around BCRX stayed unchanged within ‘bearish’ territory over the past 24 hours, accompanied by ‘low’ levels of retail chatter.

However, a Stocktwits user expressed surprise at the deal and opined that the additional cash makes it easier for the company to find a buyer if that is what it intends to do.

Another opined that the deal makes the company an ‘irresistible candy’ with no debt.

Biocryst had also said in May that it expects to be profitable for the full year 2025, a year ahead of schedule.

BCRX stock is up by 28% this year and by about 58% over the past 12 months.

Read Next: Meta Slams EU As ‘Closed For Business’ After $200M Fine, Warning of Daily Penalties

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)