Advertisement|Remove ads.

Bitcoin Mining Stocks Struggle Even As BTC Recovers After Trump’s Tariff Pause: Retail Sentiment Wavers

Bitcoin mining stocks continued to plummet on Monday in reaction to President Donald Trump’s announcement of tariffs on China, Mexico, and Canada.

However, Bitcoin itself managed to pare losses mid-morning after Trump indicated a one-month delay in implementing tariffs against Mexico.

Bitcoin edged up 0.4% over the past 24 hours, trading around $98,000 – still below the key psychological threshold of $100,000 – according to CoinGecko.

However, this uptick was not enough to lift some of the largest Bitcoin mining stocks out of the red.

Marathon Holdings Inc. (MARA) remained down over 4% in mid-day trade on Monday despite Bitcoin’s correction.

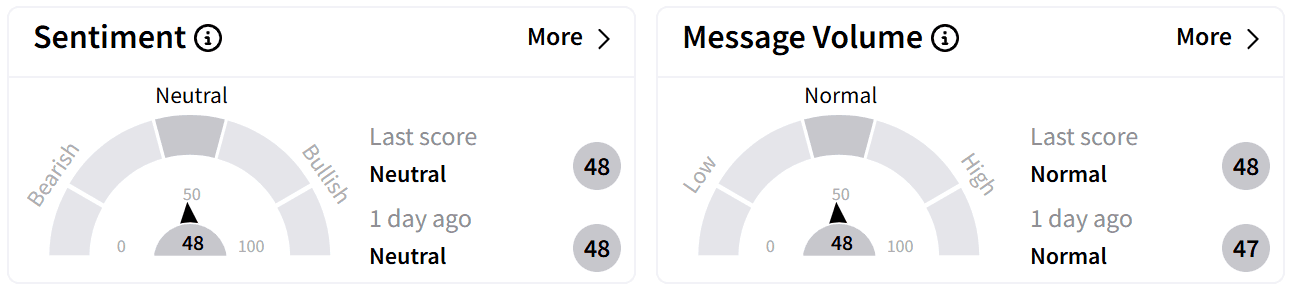

On Stocktwits, retail sentiment around the stock was in the ‘neutral’ zone as message volumes remained at ‘normal’ levels.

The company also released a mining update for December on Monday showing it mined 750 Bitcoin last month, down about 13% from 865 Bitcoin mined in November.

Its total Bitcoin holdings now add up to 44,893 BTC valued at around $4.4 billion, according to BitcoinTreasuries. It is the second-largest holder of the apex crypto after Michael Saylor’s MicroStrategy Inc. (MSTR).

Some users on Stocktwits recommended ‘buying the dip,’ keeping faith that Trump’s policies will eventually result in a bull market.

Despite last week’s volatility, MARA's stock is still holding onto gains of over 6% in the last year.

Meanwhile, shares of Canadian Bitcoin miner Hut 8 Corp. (HUT) were down nearly 5% in mid-day trade on Monday.

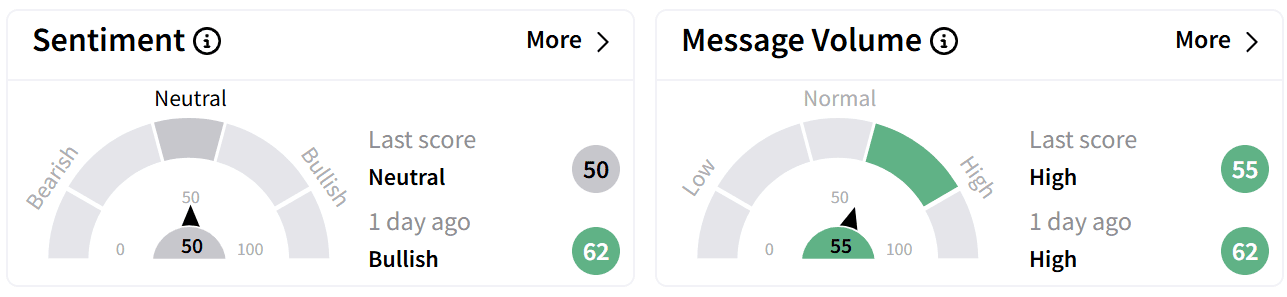

On Stocktwits, retail sentiment dipped to ‘neutral’ from ‘bullish’ a day ago accompanied by ‘high’ levels of chatter.

While some investors were optimistic about an upcoming press conference from Trump’s crypto czar, David Sacks, on Tuesday, others opted to book profits, citing heightened market volatility under the new administration.

Hut 8’s stock has more than quadrupled in value over the last year, but today’s drop can cancel out January gains, with the stock down 5% so far in 2025.

Cipher Mining was also down nearly 5% in mid-day trade on Monday.

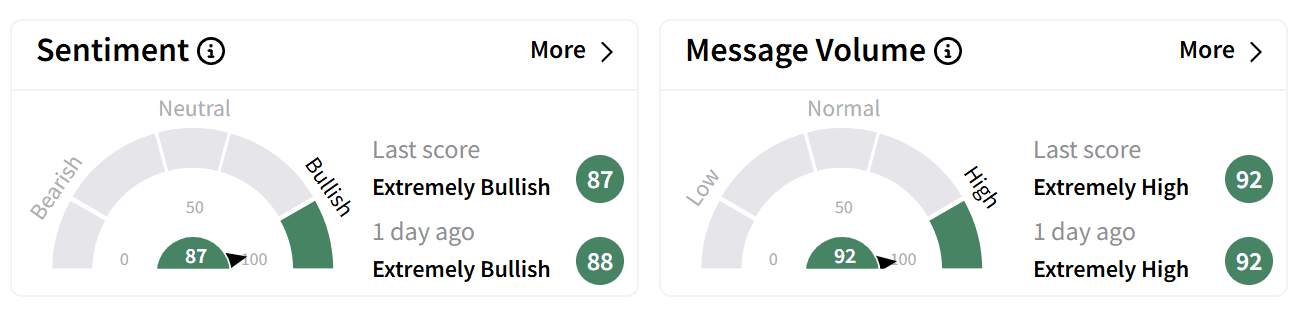

However, unlike its peers, retail sentiment on Stocktwits around the stock was ‘extremely bullish’ accompanied by ‘extremely high’ levels of chatter.

Many retail investors dismissed tariff-related concerns, pointing to SoftBank’s recent investment as a sign of strong future prospects.

Some attributed the stock's volatility to market manipulation linked to Trump's policies, expressing confidence in a swift rebound.

Cipher Mining’s stock has more than doubled in value over the last year, recording gains of 13% so far in 2025 despite the recent volatility.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: BTC, ETH, XRP Crash Wipes Out January Gains After Tariff Shock: Retail Lashes Out At Trump

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)