Advertisement|Remove ads.

BKNG Stock Falls To Over 16-Month Lows – Brokerages Flag AI-Related Uncertainties

- Oppenheimer said BKNG shares are trading at depressed valuations due to concerns about potential AI disruption.

- Barclays noted that Booking’s margin expansion was “a touch light.”

- Earlier, Booking’s board approved a 25-for-1 stock split, which will take effect on April 2.

Shares of Booking Holdings (BKNG) fell more than 8%, hitting their lowest level since September 2024, after a wave of bearish brokerage calls overshadowed the company’s better-than-expected fourth-quarter results.

Booking posted a 16% increase in its fourth-quarter (Q4) revenue to $6.3 billion, above the $6.13 billion Street estimates, according to Fiscal AI data, and projected low-double-digit revenue growth for fiscal 2026. The company also announced reinvestments of around $700 million above its baseline investments in 2026 to advance GenAI capabilities.

Separately, its board approved a 25-for-1 stock split, which will take effect on April 2, with shares set to begin trading on a split-adjusted basis on April 6.

Analysts Say AI Disruption Could Weigh On Stock’s Valuation

Cantor Fitzgerald reduced its price target to $4,495 from $5,830 and maintained a ‘Neutral’ rating. Analyst Deepak Mathivanan noted that while Booking’s underlying fundamentals remain solid, uncertainty around AI developments could weigh on valuation multiples in the near- to medium-term.

Oppenheimer noted the shares are trading at depressed valuations due to concerns about potential AI disruption, which it believes are overstated. While the firm slashed the price target to $6,000 from $6,500, it maintained an ‘Outperform’ rating.

Barclays cut Booking’s price target to $5,500 from $6,250 while maintaining an ‘Overweight’ rating, according to The Fly. However, it still represents a 40% premium over the current price of about $3,954. While the firm described the earnings as “decent,” it noted that Booking’s margin expansion was “a touch light” and the shares may face near-term pressure.

How Did Stocktwits Users React?

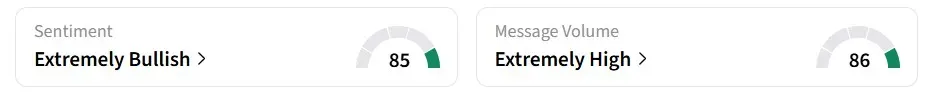

Despite the intraday slide, retail sentiment on Stocktwits turned ‘extremely bullish’ amid ‘extremely high’ message volumes.

One Stocktwits user sees the dip as a buying opportunity.

Year-to-date, the stock has declined more than 25%.

Read also: BTM Stock Pares Early Losses After Company Announces 1-For-7 Reverse Stock Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)