Advertisement|Remove ads.

Blackbuck Shines As Diwali 2025 Bet: SEBI Analyst Sees Breakout Potential Above ₹740

SEBI-registered analyst Varunkumar Patel has identified Blackbuck (formerly known as Zinka Logistics) as his Diwali 2025 stock pick.

Patel is bullish on India’s largest digital trucking platform, given its solid market position, revenue mix & monetisation, and institutional backing. However, he also cautioned that the platform's profitability relies on achieving scale, which means high retention and monetization while effectively managing incentives for drivers and operators.

Blackbuck’s margins could also take a hit due to competition and pricing pressures. And traders are advised to watch out for any large block deals, promoter activity, or FII (Foreign Institutional Investor) activity that could lead to stock price fluctuations.

On the technical side, Varunkumar Patel highlighted that as of mid-October 2025, the recent swing high stood near ₹720, marking an immediate resistance zone. In the short to medium term, immediate resistance for Blackbuck stock has been identified between ₹720 and ₹740 (recent swing high area).

On the downside, near-term support is seen around ₹650, where buyers have tended to step in during recent pullbacks. Patel said that a stronger structural support lies near ₹580, corresponding to a prior consolidation region and gap-fill observed in recent weeks.

Trading call

He flagged two scenarios for Blackbuck: a bullish scenario could unfold if the stock breaks and sustains above the ₹740–₹770 range, opening the path to retest prior highs and target levels around ₹825 and ₹900. This would signal continued momentum.

On the other hand, a bear case scenario would occur if Blackbuck breaks below ₹580 with higher volumes, indicating a deeper correction and downside risk toward the ₹480–₹520 zone. This would warrant a close monitoring of daily volume behavior.

What is the retail mood on Stocktwits?

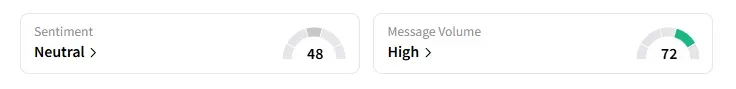

Data on Stocktwits showed that retail sentiment moved from ‘bullish’ to ‘neutral’ a day ago.

Blackbuck shares have rallied 43% so far this year.

Disclaimer: The views and opinions expressed are those of the SEBI-registered analyst/advisor mentioned in the article, and are not endorsed by Stocktwits. This is not investment advice. Please do your own research or consult a financial advisor.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)