Advertisement|Remove ads.

Blade Air Mobility Draws Investor Attention On Partnership With Skyports Infrastructure: Retail’s Unswayed

Blade Air Mobility, Inc. (BLDE) drew investor attention on Monday after the company announced a partnership with Skyports Infrastructure to offer flights between downtown Manhattan and JFK Airport.

Blade Air Mobility provides helicopter passenger service and operates in the U.S. and Europe.

The company said the new service will fly passengers transferring to and from flights at JFK. It will also cater to Long Island and Queens residents commuting to or from Manhattan for business or leisure on weekdays.

“Customers can purchase by-the-seat flights starting at $195, or from $95 with a Blade Airport Pass or a Commuter Pass for those flying between home and work,” the firm stated.

Through the pilot program, the company aims to gather data on consumer demand, flier experience, and logistics specific to the Downtown Manhattan Heliport. These insights will help accelerate and derisk the launch of Electric Vertical Aircraft (eVTOL) operations at the facility.

The alliance follows Skyports’ recent appointment by the New York City Economic Development Corporation as the operator of the Downtown Manhattan Heliport through their Downtown Skyport JV with Groupe ADP.

Nathan Alexander, Vice President of Rotorcraft for Blade, stated that EVA’s quiet and emission-free design will support the expansion of convenient landing zones while reducing commuter costs.

“From logistics, passenger experience, booking, ground crew, and even flight time, EVA services will be nearly identical to Blade’s current helicopter offerings, but using next-generation aircraft,” he said.

Recently, Lake Street analyst Ben Klieve initiated coverage of the stock with a ‘Buy’ rating and a price target of $6.50.

According to TheFly, Lake Street said that Blade has "transformed its business for the better over the last 24 months in an overlooked and undervalued manner.”

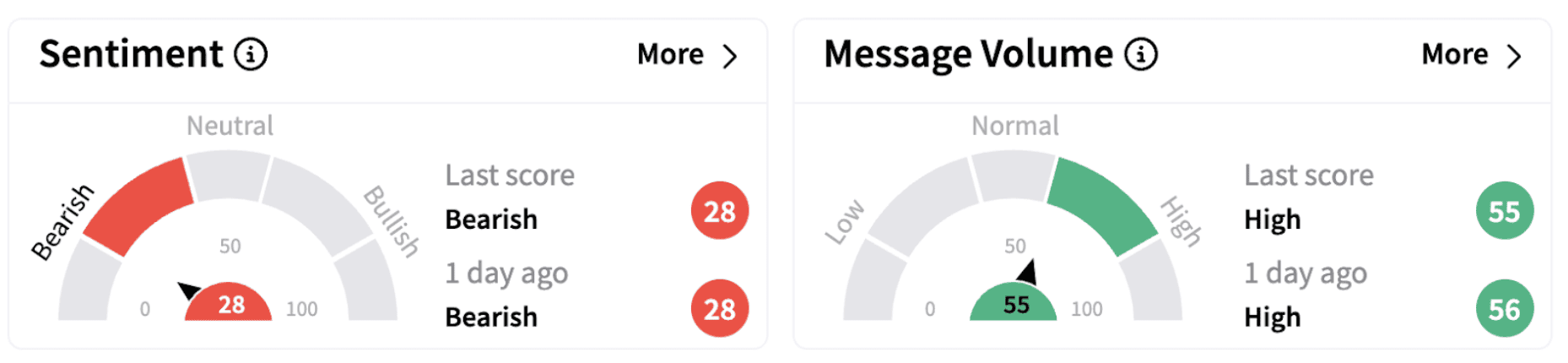

Meanwhile, retail sentiment on Stocktwits continued to trend in the ‘bearish’ territory (28/100), accompanied by ‘high’ message volume.

BLDE shares lost over 29% year-to-date and are down over 25% in the past year.

Also See: Cohen & Company Stock Falls After Company Registers Losses In Fourth Quarter — Retail’s On The Fence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)