Advertisement|Remove ads.

Bloomin’ Brands Stock Dives To One-Year Low After Q4 Revenue Fall: Retail Sentiment Turns Gloomy

Shares of Bloomin’ Brands Inc. (BLMN) plummeted nearly 17% on Wednesday to a one-year low after the fast casual dining chain posted worse-than-expected fourth-quarter revenue and gave disappointing guidance for 2025, dampening retail sentiment.

For the latest quarter, its earnings per share came in at $0.38, slightly above the Wall Street estimate of $0.37. But revenue was down nearly 9.3% to $972.02 million from the year-ago quarter, and missing Wall Street estimates of $1.09 billion.

The decrease in total revenue from continuing operations was due to the 53rd week included in 2023 and the net impact of restaurant closures and openings, the company said.

Its combined U.S. same-store Q4 sales fell 1.1% compared to last year. Its Q4 restaurant-level operating margin decreased due to lower revenues, higher labor, operating and commodity costs, and higher insurance and legal expenses, among other factors.

Bloomin’ Brands’ portfolio includes Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill and Fleming’s Prime Steakhouse & Wine Bar.

“In my first six months, I have become even more confident that we have iconic brands with a strong right to succeed in on-trend, large scale categories,” said Mike Spanos, CEO. “I am also aware that our current results are not what we expect and are not representative of our potential. We are making changes to address our near-term execution as well as drive sustainable sales and profit growth. Our guidance for the first quarter and full year is reflective of where we are and our go-forward short term performance.”

For 2025, it expects U.S. comparable restaurant sales to decline by 2.0% or remain flat. Adjusted diluted EPS is projected between $1.20 and $1.40. That is below the consensus estimate of $1.77 .

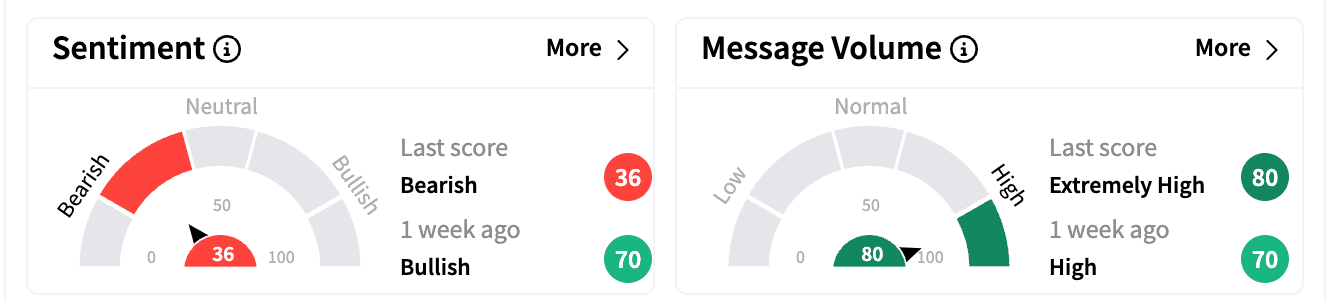

Sentiment on Stocktwits turned ‘bearish’ compared to ‘bullish’ a week ago. Message volume jumped to ‘ extremely high’ territory from ‘high.’

One bearish comment advised to “stay away” calling the price movement “catching a falling knife.”

The company has also declared a quarterly cash dividend of $0.15 per share, payable on March 26, to stockholders of record at the close of business on March 11, 2025.

It also repurchased 10.1 million shares for a total of $265.7 million during 2024 with $96.8 million of share repurchase authorization remaining under the 2024 share repurchase program.

Bloomin’ Brands stock is down 19% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)