Advertisement|Remove ads.

BNP Paribas Exane Initiates Coverage On Chinese EV Makers XPeng, Li Auto With Muted Price Targets

BNP Paribas Exane on Monday initiated coverage on Chinese EV makers Li Auto (LI) and XPeng (XPEV) with ‘Underperform’ and ‘Neutral’ ratings, respectively.

The brokerage has a ‘Neutral’ rating and a $19 price target on XPeng and an ‘Underperform’ rating and an $18 price target on Li Auto. Both price targets represent a downside to the shares’ last closing price on Friday.

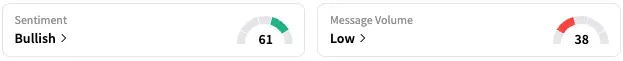

On Stocktwits, retail sentiment around Li trended in the ‘bullish’ territory over the past 24 hours, while message volume remained at ‘low’ levels.

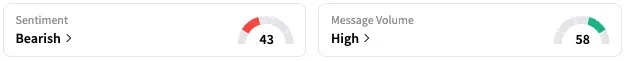

According to data from Koyfin, the average analyst price target on Li is $33.86, representing an upside of about 40%. Meanwhile, on XPeng, retail sentiment fell from ‘neutral’ to ‘bearish’ territory over the past 24 hours, while message volume remained ‘high’.

A Stocktwits user expressed pessimism for XPeng, highlighting larger market conditions, including EV market saturation and softening of the Chinese economy.

A bullish user, however, said that the company will soon be profitable.

XPeng is slated to report its second-quarter earnings on Tuesday. For the three months through the end of June, Xpeng’s revenue is expected to more than double year-on-year to $2.485 billion, according to Koyfin. Adjusted loss per share is expected to come in at $0.15, compared to a loss of $0.18 reported in the corresponding quarter of 2024.

According to Koyfin, the average price target on XPeng is $25.94, representing an upside of about 31%.

While LI stock is up by about 13% over the past 12 months, XPEV is up by about 176%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)