Advertisement|Remove ads.

Boeing’s 737 Max Production Almost At 38 Per Month, Engine Maker Safran Says: Retail Still Leans Bearish

Boeing’s (BA) production rate of its best-selling Max jets has almost reached the U.S. regulator-imposed monthly cap, said Olivier Andries, CEO of French firm Safran, a key supplier of engines to the planemaker.

Speaking at an annual meeting, Andries said that Boeing has been able to reinstate a more “dynamic” production profile after several delays that have weighed into the company’s earnings.

Safran and GE Aerospace, through their joint venture CFM International, produce a significant share of engines used in commercial airplanes. CFM's LEAP engines are used in all Boeing 737 MAX aircraft, and the company competes with Pratt & Whitney for Airbus A320neo contracts.

According to the report, a senior executive from Boeing’s Commercial Aviation segment said on Tuesday that the planemaker expects to stabilize 737 MAX production at 38 airplanes a month over the next couple of months.

Boeing was imposed with a production cap after a door plug blew out of an Alaska Airlines MAX aircraft in January 2024.

The company delivered 29 Max jets in April. Once production stabilizes at 38 for a few months, it intends to apply to the Federal Aviation Administration to lift the cap.

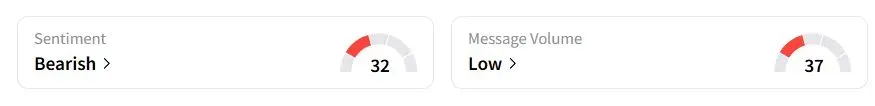

Retail sentiment on Stocktwits was in the ‘bearish’ (32/100) territory, while retail chatter was ‘low.’

One retail trader suggested that the production rate, not orders, would drive the stock in the future.

Boeing's total company backlog rose to $545 billion at the end of the first quarter, including over 5,600 commercial airplanes.

Boeing stock has gained 14.1% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)