Advertisement|Remove ads.

Boeing Stock Dips Despite Cost-Cutting Plans, But Retail Exudes Confidence

Shares of Boeing Co. (BA) dropped more than 1% on Monday, even as the aerospace giant unveiled plans to cut costs amid a factory worker strike.

The company is implementing a hiring freeze and pausing non-essential staff travel to preserve cash while negotiating a new contract with machinists.

The strike, which began after the union rejected Boeing’s offer, is adding pressure to a company already grappling with a range of challenges.

“We are working in good faith to reach a new contract agreement that reflects their feedback and enables operations to resume,” Boeing CFO Brian West said in a note to staff.

“However, our business is in a difficult period. This strike jeopardizes our recovery in a significant way and we must take necessary actions to preserve cash and safeguard our shared future,” he added.

Despite these efforts, speculation is mounting about Boeing’s financial future. An opinion piece in The Financial Times suggested that the company may be heading for a “mega” equity raise to shore up liquidity and avoid disruptions in the credit market.

Boeing’s debt load stands at approximately $45 billion, while it has $12.6 billion in cash and securities and $10 billion in undrawn credit facilities.

Moody’s has placed Boeing’s credit ratings under review for a potential downgrade due to concerns about the machinists’ strike impacting cash flow. Boeing’s current Baa3 rating is the lowest investment grade. Moody’s said it would evaluate the strike’s duration, cash flow impact, and the possibility of Boeing raising equity to boost liquidity.

Meanwhile, S&P Global Ratings, which also rates Boeing at the lowest investment grade (‘BBB-minus’), said its rating is unaffected for now, citing Boeing’s large order backlog and near-duopoly with Airbus.

A downgrade to “junk” status from either agency could hurt Boeing’s borrowing ability. Both Moody’s and S&P noted that Boeing may consider issuing equity to strengthen its finances.

Boeing shares are down more than 38% this year, battered by design flaws linked to fatal crashes, allegations of prioritizing profits over safety, dwindling aircraft sales, and its mounting debt.

However, retail investors are showing confidence in the company’s turnaround efforts.

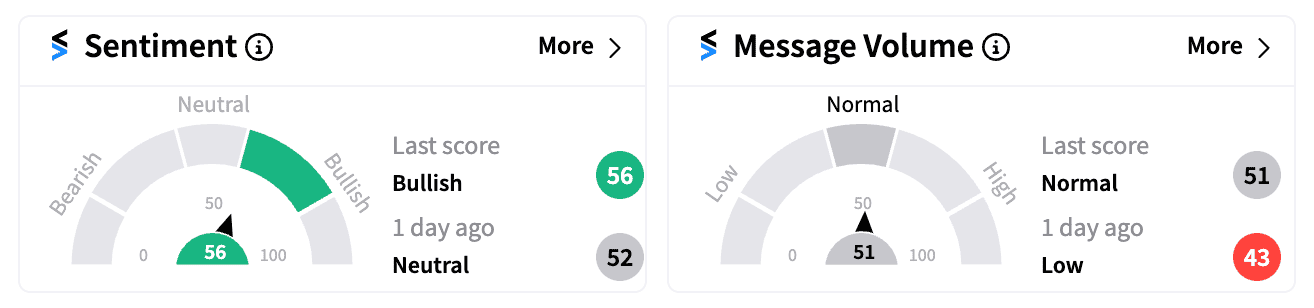

On Stocktwits, retail sentiment for Boeing turned ‘bullish’ (56/100) from ‘neutral’.

One user posted, “$BA to the moon, better get in while you can.”

Another speculated that the current strike won’t last long due to pressure from all sides—customers, government, and the public—making the stock ripe for a rebound once the labor dispute is resolved.

As Boeing navigates this turbulent period, much of its future hinges on resolving the strike, expanding deliveries of its 737 Max planes, and generating positive free cash flow by 2025.

Read next: Bausch + Lomb Stock Surges On Report Of Potential Sale: Retail Cheers Even As Analysts Assess Impact

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)