Advertisement|Remove ads.

Boeing Stock Heads For Worst Month Since Last Year — Retail Bulls Hold Ground After Pentagon Awards Contracts Worth $7B

- The recent declines followed the company's third-quarter loss, partially weighed down by delays in deliveries of its large-body 777X aircraft.

- The company was dealt a further jolt this week after NASA cut the number of crewed missions under the Boeing Starliner contract due to engineering issues.

- The company got the contracts to deliver Apache AH-64E attack helicopters and KC-46A Pegasus aerial refueling tankers.

Boeing Co.’s (BA) stock drew retail chatter late on Tuesday after the Pentagon awarded the aerospace giant with two contracts with a combined value of about $7 billion.

The Department of Defense, renamed as the Department of War by the Trump administration, awarded the firm a fixed-price contract to procure new-build Apache AH-64E attack helicopters, Longbow crew trainers, and associated components, spares, and accessories. Boeing will carry out the work in its facility in Mesa, Arizona, and the contract is expected to be completed by 2032.

The U.S. Air Force also awarded a Lot 12 contract for 15 additional KC-46A Pegasus aerial refueling tankers, valued at $2.47 billion. Boeing will build the aircraft at its Seattle facility and expects it to be completed by June 30, 2029.

“Getting on contract helps ensure production stability, including our long-lead supply chain, to continue delivering the unmatched capability of the KC-46A,” said Jake Kwasnik, vice president and KC-46 program manager.

Stock Headed For Worst Month Since September 2024

The company’s shares have fallen 9.2% so far in November, keeping the firm on track for the monthly decline since September last year, when over 30,000 Boeing workers went on strike. The stock has closed higher in only two of the previous ten sessions.

The recent declines followed the company's third-quarter loss, partially weighed down by delays in deliveries of its large-body 777X aircraft. The firm booked a $4.9 billion pre-tax charge due to the delay and now expects to bring its 777X aircraft to customers in 2027. "For those focused on short-term cash, the outlook coming out of Q3 was negative and indicated that there will be negative revisions to 2026 free cash flow estimates,” Bernstein analysts wrote.

The company was dealt a further jolt this week after NASA cut the number of crewed missions under the Boeing Starliner contract due to engineering issues. The alterations reduced the value of Boeing's contract to $3.732 billion from $4.5 billion, Reuters reported, citing a NASA spokesperson. NASA also said the next Starliner mission will be an unmanned cargo delivery to the International Space Station.

Last year, Starliner's first crewed test flight carrying NASA astronauts Butch Wilmore and Sunita Williams did not go according to plan, with several thrusters on the spacecraft’s propulsion system shutting down during its approach to the ISS.

What Are Stocktwits Users Saying?

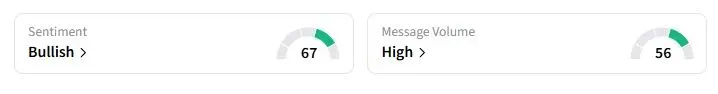

Retail sentiment on Stocktwits about Boeing was in the ‘bullish’ territory at the time of writing.

“Sales booming, production increasing, government contracts popping off. Not many better places to be buying,” one trader wrote.

“We need to be a part of NASA launches. Let's go, Boeing, get it done,” another trader wrote.

Boeing shares have gained about 2% this year, underperforming the 38.4% gain of the iShares US Aerospace & Defense ETF. The company, however, received the approval to raise the output of its bestselling 737 Max jets to 42 per month and sits on a backlog of thousands of aircraft — a large portion of which stems from President Donald Trump’s dealmaking with several countries as he negotiates tariff agreements.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)