Advertisement|Remove ads.

BofA’s Price Target Hike On Dell Stock Makes Retail Believe There’s ‘Opportunity’

Dell Technologies Inc. (DELL) received a fresh boost from Bank of America as the firm raised its price target on the stock to $165, up from $155, while maintaining a ‘Buy’ rating.

According to TheFly, the revised outlook reflects optimism over the company’s long-term positioning in the artificial intelligence space, especially in serving enterprise and government-related demand.

Following the price target hike, Dell Technologies stock traded over 6% higher on Friday afternoon.

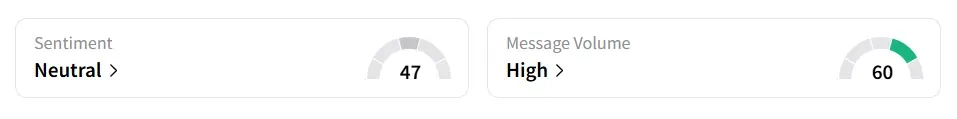

On Stocktwits, though retail sentiment around Dell Technologies was in ‘neutral’ (47/100) territory, while message volume levels were ‘high’(60/100).

Bank of America sees Dell as a key beneficiary of growing investment in AI infrastructure and services, with hardware expected to play a central role in that evolution.

A Stocktwits user noted that they see an opportunity in the stock following the price target increase.

Another user declared Dell a winner.

The brokerage also raised its full-year fiscal 2026 revenue forecast to $106.8 billion from $105 billion and slightly increased its earnings-per-share (EPS) estimate to $9.49 from $9.40.

Dell reported revenue of $23.4 billion for the first quarter (Q1) of the fiscal year 2026, up 5% year over year (YoY) and exceeding the consensus estimate of $23.19 billion, as per Fiscal AI data.

However, the standout figure was $12.1 billion in artificial intelligence orders in Q1, surpassing the total shipments for all of FY25 and leaving the company with a backlog of $14.4 billion.

For the second quarter (Q2), Dell expects revenue to be between $28.5 billion and $29.5 billion. For 2026, revenue is estimated to be between $101.0 billion and $105.0 billion.

Dell stock has gained over 13% year-to-date and 4% in the last 12 months.

Also See: Stocks Versus Crypto: Retail Traders Caught In A Bullish Tug-Of-War

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)