Advertisement|Remove ads.

Booking Holdings Says Q3 Revenue Growth To Slip After Q2 Results Boosted By International Travel

Booking Holdings (BKNG) on Tuesday said its revenue growth in the ongoing quarter will deaccelerate, sending its shares down 2% in premarket trading on Wednesday.

The forecast put a dampener on second-quarter results, which came in higher than expectations.

The travel sector has broadly been under pressure recently, as consumers grow more selective about vacations amid economic uncertainty and government budget cuts, leading to reduced bookings from officials.

Booking's revenue rose 16% to $6.8 billion last quarter, beating analysts' estimate of $6.57 billion from LSEG/Reuters. Room nights grew 8%.

Growth was driven by surging international bookings, especially from affluent Chinese tourists traveling within Asia, the company said.

Adjusted profit was $55.40 per share, also higher than the analysts' estimate of $50.22 per share.

For the third quarter, Booking expects revenue to grow between 7% and 9% year-over-year, and room nights to increase by 3.5% to 5.5%.

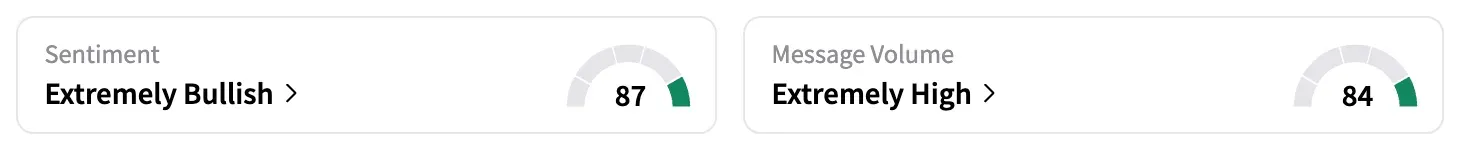

On Stocktwits, the retail sentiment shifted to 'extremely bullish' as of early Wednesday from 'bullish' the previous day.

One user pointed out that it would be unwise to buy shares at this point, given the recent surge in share price.

Booking shares are up 12.5% year-to-date, compared to the 8.4% rise in SPDR S&P 500 ETF (SPY), which tracks S&P 500 stocks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)