Advertisement|Remove ads.

Boston Scientific Discontinues Worldwide Sales Of Acurate Aortic Valve Systems: But Retail Sentiment Brightens

Shares of Boston Scientific Corporation (BSX) traded 1% lower on Wednesday afternoon after the company announced that it is discontinuing worldwide sales of the Acurate neo2 and Acurate Prime Aortic Valve Systems and no longer pursuing approval for Acurate in the U.S. or other geographies.

The company said in a regulatory filing that the decision was made in light of increased clinical and regulatory requirements to maintain regulatory approvals in global markets and to obtain approvals in new regions.

The company noted that the additional resources and investments required to satisfy these requirements are prohibitive for the company.

The firm, however, said that it expects to achieve its second quarter and full year 2025 reported and organic sales and adjusted earnings per share (EPS) guidance issued last month.

The company expects full-year adjusted EPS, excluding certain charges, of $2.87 to $2.94. Net sales for the full year is expected to grow by 15% to 17% compared to 2024.

For the second quarter, the company estimates adjusted EPS, excluding certain charges, of $0.71 to $0.73, and net sales growth of between 17.5% and 19.5%.

However, the company did not reaffirm its second-quarter and annual GAAP EPS guidance.

Last month, the company had estimated full-year EPS on a GAAP basis in a range of $1.86 to $1.93 and GAAP EPS in the range of $0.45 to $0.47 for the second quarter.

Following the company’s announcement, JPMorgan said in a research note that the news comes as “zero surprise” after Boston delayed its initial submission to the FDA, and Acurate neo2 was proven inferior to devices from Edwards Lifesciences (EW) and Medtronic (MDT) in a recent study published in The Lancet.

JPMorgan has kept an ‘Overweight’ rating on Boston Scientific with a $135 price target. The company believes that the move, while it takes some near-term upside off the table for Boston Scientific, is the right long-term strategic decision for the company.

Citi analyst Joanne Wuensch also said that the discontinuation is a “wise move” when thinking about resource management.

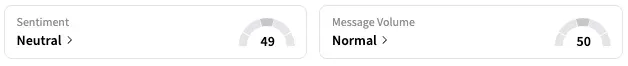

On Stocktwits, retail sentiment around BSX rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume jumped from ‘low’ to ‘normal’ levels.

BSX stock is up by about 18% this year and by about 40% over the past 12 months.

Read Next: Apple Extends Self Service Repair To iPads: But Retail’s Unconvinced

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)