Advertisement|Remove ads.

CME Markets Reopen After Global Trading Halt: Report

- The shutdown affected futures and options covering a wide range of assets.

- CME noted that its BrokerTec venue in Europe remained fully operational.

- The freeze has already lasted longer than a comparable outage caused by a tech glitch in 2019.

Trading across futures, options, and currency platforms at the CME Group (CME) reportedly reopened in full on Friday morning after a shutdown caused by a cooling system issue at one of its data centers.

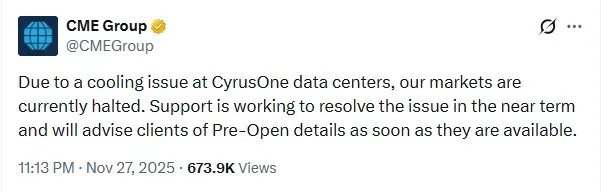

In a post on the X platform, CME cited a cooling malfunction at a data facility operated by CyrusOne that disrupted the systems that support several major markets.

Trade Resumption

According to a CNBC report, trading in stock futures and options resumed at 8:30 a.m. ET, while other services were gradually brought back. Bonds and metals resumed activity after a brief halt.

“All CME Group markets are open and trading,” said a CME Group spokesperson.

Market Outage Triggers Wide Halt

The interruption forced key platforms tied to CME Group to suspend activity while engineers moved to stabilize the environment. CME noted that its BrokerTec venue in Europe remained fully operational.

According to a Bloomberg report, the shutdown affected futures and options covering a wide range of assets, from equity indexes and bonds to commodities and currencies.

The freeze halted trading in U.S. index futures, including contracts linked to the S&P 500, Nasdaq-100, and the Dow, as well as U.S. Treasury, FX, energy, and commodities futures such as crude oil, palm oil, and gasoline.

CME stock inched 0.6% lower in Friday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day. Message volume improved to ‘high’ from ‘normal’ levels in 24 hours.

Volatility Risk

The current freeze has already lasted longer than a comparable outage caused by a tech glitch in 2019, highlighting how deeply CME and its Globex platform are woven into global markets, said the report.

The outage struck during an already quiet session following the Thanksgiving holiday, when activity traditionally declines. CME Group is a major global market where investors can trade futures, options and other financial products.

CME stock has gained over 20% in 2025 and over 18% in the last 12 months.

Also See: Is The Stock Market Open Today? Dow Futures Muted Heading Into Shortened Session

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)