Advertisement|Remove ads.

Two Moves Trump’s ‘Cronies’ Made That Have Krugman Worried About 2008-Style Meltdown

- Krugman took umbrage with attempts to loosen bank capital requirements that were put in place to prevent them from taking undue risks that could threaten the financial security of the U.S. economy.

- The GENIUS Act establishes a regulatory framework for stablecoins, requiring them to be fully backed by liquid assets like the U.S. dollar and government securities.

- In July, Federal Reserve Governor Michael Barr emphasized the importance of ensuring regulations are robust enough to prevent economic downturns.

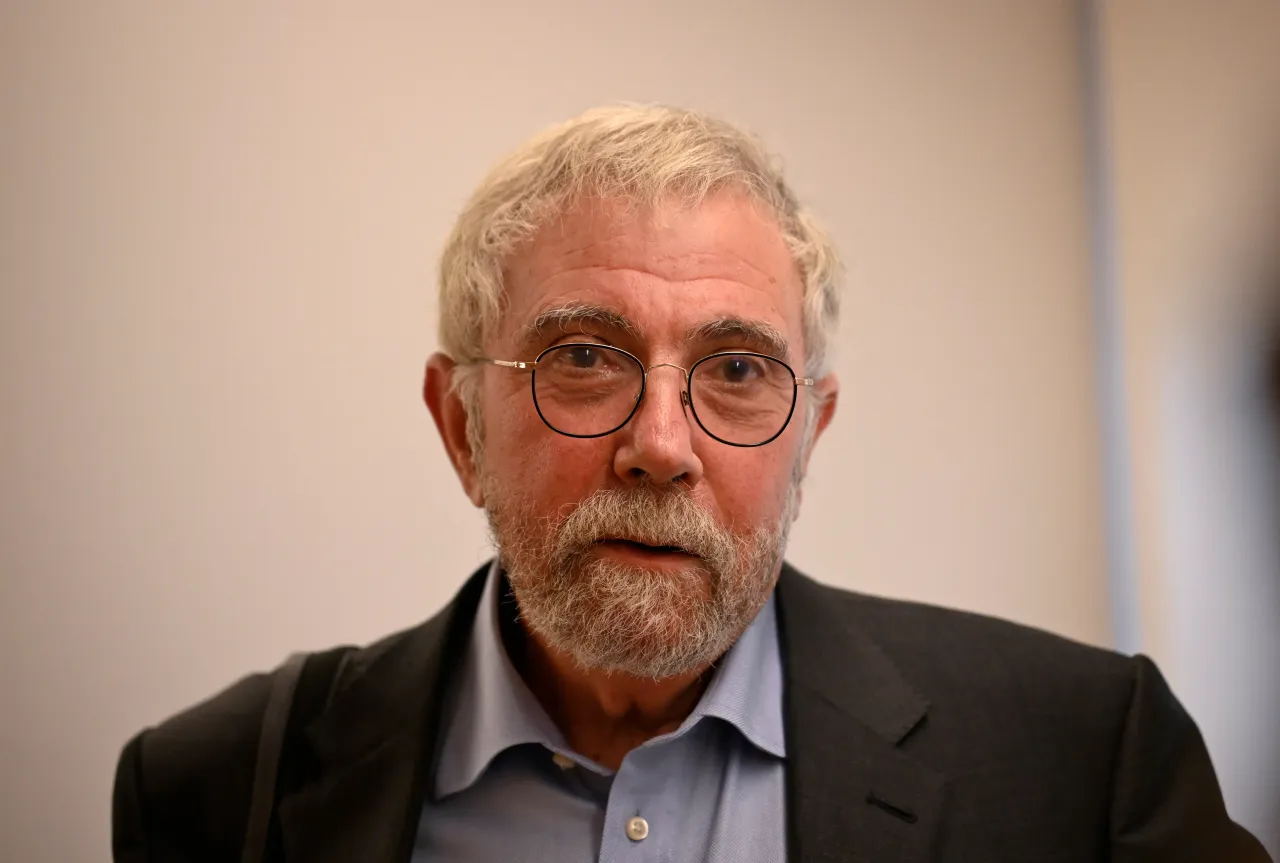

Economist Paul Krugman on Friday warned that President Donald Trump’s policies are undermining the financial stability of the U.S. economy.

Terming it a “MAGA war” on financial stability, Krugman sounded the alarm bells by pointing out that President Trump’s appointee to the Federal Reserve, Michelle Bowman, has advocated for the rollback of stringent bank capital requirements.

Krugman also pointed to the passing of the GENIUS Act in July to promote stablecoins as the second policy concern threatening the financial stability of the U.S. economy.

The GENIUS Act establishes a regulatory framework for stablecoins, requiring them to be fully backed by liquid assets, such as the U.S. dollar and government securities.

Loosening Bank Capital Requirements

Krugman took umbrage with attempts to loosen bank capital requirements that were put in place to prevent them from taking undue risks that could threaten the financial security of the U.S. economy.

“The Fed is supposed to be quasi-independent, and so far it has preserved its interest-rate-setting independence in the face of intense pressure by Trump to cut rates. Yet a Trumpian agenda is attempting to overtake the Fed’s bank supervision operations,” he said.

In July, Federal Reserve Governor Michael Barr emphasized the importance of ensuring regulations are robust enough to prevent economic downturns.

He added that while easier banking rules help drive risk-taking during economic booms, they also increase vulnerability, and a subsequent downturn makes the situation more painful.

“In principle, financial regulation should incentivize banks to engage in responsible risk-taking and build up resources in good times, so that they can deal with times of financial stress and continue their vital role in the economy in bad times,” Barr said.

GENIUS Act

Krugman also called out support for the GENIUS Act by the Trump administration and its allies, as well as several Democrats, stating that the law is the “second front of MAGA’s war on financial stability,” on behalf of the crypto industry.

He drew a corollary between stablecoins and private banking in the 19th century. “How do stablecoins compare with 19th century private banking? One fact rarely mentioned about the stablecoin industry is that it’s dominated by two big issuers, Tether and USDC, with the rest consisting of a grab-bag of minor coins that collectively are much smaller than either,” Krugman said.

Meanwhile, U.S. equities gained in Friday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.46%, the Invesco QQQ Trust ETF (QQQ) rose 0.57%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.63%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.22% at the time of writing.

Also See: Is The Stock Market Open Today? Dow Futures Muted Heading Into Shortened Session

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)