Advertisement|Remove ads.

BP To Sell Stakes In US Assets For $1.5B In Cost-Cutting Drive

- In February, the company revealed its intention to raise $20 billion through divestments by 2027.

- BP’s aggressive move to cost cuts came after years of underperformance compared to peers such as ExxonMobil and Chevron.

- BP is set to report its quarterly earnings on Nov. 4.

BP announced on Monday that it will sell stakes in some of its U.S. midstream assets to funds managed by investment firm Sixth Street for $1.5 billion, as part of its efforts to lower costs and streamline operations.

The London-listed firm stated that its assets include midstream facilities in the Eagle Ford and Permian basins, comprising four Permian central processing facilities: Grand Slam, Bingo, Checkmate, and Crossroads. These assets connect wells to third-party pipeline systems, transporting oil and gas to customers.

BP said following the closing of the agreements, the firm’s U.S. unit BPX’s ownership interest in the Permian midstream assets will move to 51% from 100%, while BPX’s ownership interest in the Eagle Ford midstream assets will move to 25% from 75%.

Why Is BP Moving Forward With The Deal?

In February, the company revealed its intention to raise $20 billion through divestments by 2027. It also set a goal of reducing net debt to between $14 billion and $18 billion by 2027, down from nearly $23 billion as of last year.

BP’s aggressive cost-cutting move came after years of underperformance compared to peers such as ExxonMobil and Chevron, following failed bets on renewable energy amid a boom in oil prices. The firm also pledged in February to raise its output of fossil fuels in a strategic shift.

The effect on non-controlling interest reported in the income statement is projected to be in the range of $100 million to $200 million per year, BP said.

What Is Retail Thinking?

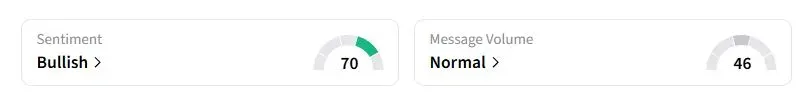

Retail sentiment on Stocktwits about BP was in the ‘bullish’ territory at the time of writing.

BP U.S. shares have gained over 18% this year, nearly matching Shell while far outpacing the meager gains of ExxonMobil and Chevron.

BP is set to report its quarterly earnings on Nov. 4.

Also See: Oil Prices Gain After OPEC+ Pauses Output Hike — Analyst Says Focus Shifts To Price Stability

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1207431426_jpg_b8d7c6d852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_rigetti_computing_quantum_computer_representative_resized_bafe11454b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_red_cat_holdings_representative_resized_071bc0311e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)