Advertisement|Remove ads.

Bridge Investment Group Stock Rockets 33% After Apollo To Acquire Company In $1.5B All-Stock Transaction: Retail’s Exuberant

Global alternative asset manager Apollo (APO) announced on Monday that it will acquire Bridge Investment Group Holdings Inc. (BRDG) in an all-stock transaction with an equity value of approximately $1.5 billion.

Following the announcement, BRDG shares shot up 33% at the opening bell on Monday, headed toward their best single-day gains since listing in July 2021.

Bridge, too, is an alternative investment manager, diversified across specialized asset classes, with approximately $50 billion of assets under management as of Dec. 31, 2024.

Upon the deal's closing, Bridge stockholders and Bridge OpCo unitholders will receive 0.07081 shares of Apollo stock for each share of Bridge Class A common stock and each Bridge OpCo Class A common unit, respectively. The companies have valued these at $11.50 per share of Bridge Class A common stock and Bridge OpCo Class A common unit, respectively.

Following the deal, Bridge will operate as a standalone platform within Apollo’s asset management business, retain its existing brand, management team and dedicated capital formation team. Bridge Executive Chairman Bob Morse will become an Apollo Partner and lead Apollo’s real estate equity franchise.

The deal is expected to provide Apollo with immediate scale to its real estate equity platform and enhance Apollo’s origination capabilities in both real estate equity and credit. This will benefit Apollo’s growing suite of hybrid and real estate product offerings, the company said.

The transaction is expected to close in the third quarter of 2025, and upon closing, shares of Bridge common stock will no longer be listed on the New York Stock Exchange.

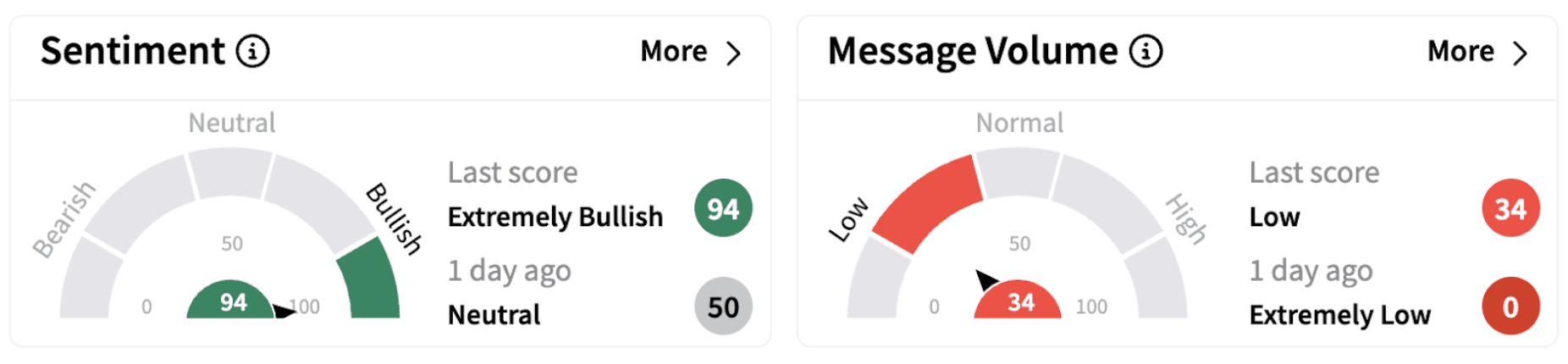

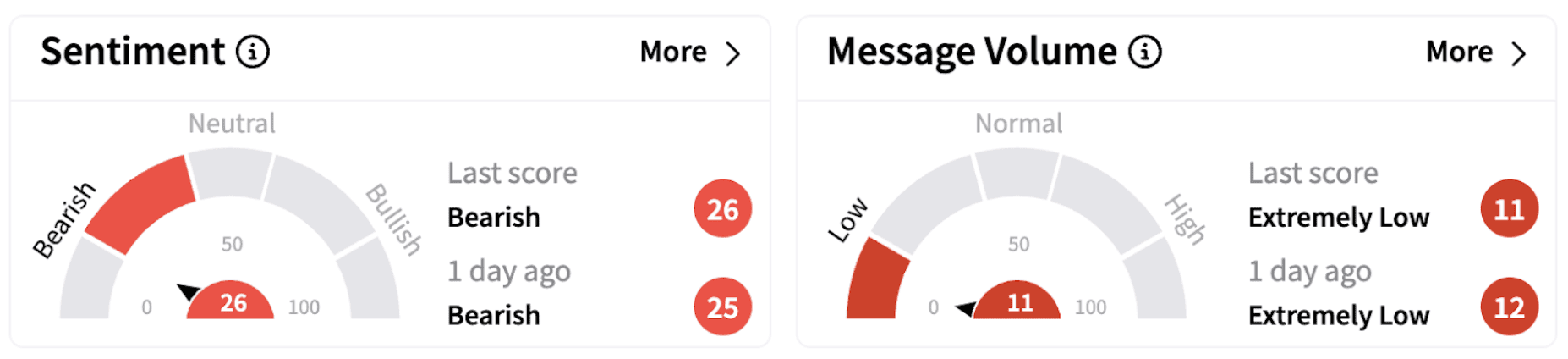

Following the announcement, retail sentiment surrounding BRDG climbed into the ‘extremely bullish’ territory (94/100) from ‘neutral’ a day ago.

However, sentiment surrounding APO continued to trend in the ‘bearish’ territory.

BRDG shares gained over 28% in 2025, while APO shares lost over 8% during the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Mojtaba_Khamenei_jpg_d2c198ccb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Biotech_lab_research_4e46efbd94.jpg)