Advertisement|Remove ads.

Brigade Launches ₹2,500 Crore Luxury Housing Project In Bengaluru, But Stock Charts Stay Bearish

Brigade has signed a joint development luxury residential project in East Bengaluru, boasting an impressive Gross Development Value (GDV) of ₹2,500 crore.

The project will span across 10.75 acres of land, with a total saleable area potential of 2.5 million square feet, the real estate developer said.

Speaking about the project, Pavitra Shankar, Managing Director, Brigade Enterprises, said, "Bengaluru is our primary market, and this new development reflects our strategic commitment to focus on high-quality developments in premium micro markets that combine connectivity, infrastructure, and lifestyle appeal."

SEBI-registered analyst Vatsal Khemka called this a strong fundamental positive, reflecting robust demand in Bengaluru’s premium real estate market. However, he cautioned that the technical charts indicate a bearish structure.

Momentum indicators are weak, suggesting a lack of immediate upside and no clear reversal signals on the charts for Brigade stock.

What Should Traders Do?

Khemka said that despite the strong fundamental news, technicals do not support any bullish entry at current levels. He advised traders to ideally stay on the sidelines and avoid forcing trades when risk-reward is not in their favor.

What Is The Retail Mood?

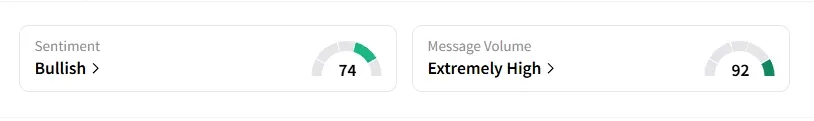

However, data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week amid 'extremely high' message volumes.

Brigade shares have declined 26% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)