Advertisement|Remove ads.

Brighthouse Financial Stock Surpasses 200-DMA For First Time In A Month Following Report About Aquarian Take-Private Deal

- The potential deal values Brighthouse at $4 billion, according to a Financial Times report.

- The deal could be announced this weekend, the report said.

- It also stated that Mubadala Capital, which invested $1.5 billion in Aquarian last year, is expected to provide equity funding.

Shares of Brighthouse Financial Inc. (BHF) shot up over 22% in early trade on Friday, breaching its 200-day moving average for the first time in a month, after a report indicated that Aquarian Holdings is in advanced talks for a $4 billion take-private deal with the insurer.

The acquisition by investment firm Aquarian Holdings, which is backed by RedBird Capital Partners and Abu Dhabi’s sovereign wealth fund Mubadala, could be announced as early as this weekend, the Financial Times reported. However, the report added that no deal had been finalized.

Aquarian has reportedly been in advanced talks with Brighthouse for several months, with a potential offer of around $70 per share, valuing the company at roughly $4 billion. The price roughly marks a 27% premium over the current price of $55.

The FT report also stated that Mubadala Capital, which invested $1.5 billion in Aquarian last year, is expected to provide equity funding, while a consortium of banks is expected to arrange over $1 billion in debt financing.

Multiple PE Firms Showed Interest

The auction for Brighthouse attracted interest from major private equity firms, including Apollo, Carlyle, TPG, and Sixth Street, though several dropped out during due diligence, the report added.

Sixth Street had previously offered about $55 per share to acquire Brighthouse, valuing the life insurer at roughly $3.1 billion, according to a Reuters report earlier this month.

How Did Retail Investors React?

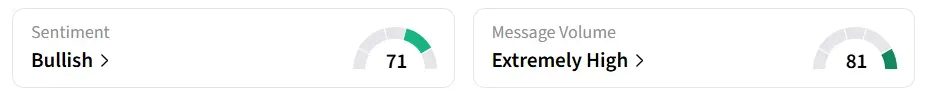

The news about the deal turned retail investors buoyant, leading to ‘extremely high’ chatter on Stocktwits. Sentiment on the platform flipped to ‘bullish’ from ‘bearish’ a day earlier.

The stock has a short interest of 6.6%. Its year-to-date gains are currently at around 16%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261087084_jpg_9cdd1d104f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)