Advertisement|Remove ads.

BTC Digital Surges To 2-Year Highs On Institutional Interest In Autozi, New Mining Deals: Retail Divided

Shares of BTC Digital ($BTCT) climbed over 14% on Thursday to hit two-year highs after its peer, Autozi Internet Technology ($AZI), filed two Schedule 13G forms with the SEC, indicating increased institutional interest in the company.

Schedule 13G forms are filed when investors acquire more than 5% of a company’s stock but don’t plan to control it, a sign often viewed as a positive signal for potential stock growth.

However, trading was halted 30 minutes into the market open, marking a second trading pause this week for BTC Digital.

The last time the stock was trading at these levels was August 2022. It has been on a massive rally since Monday, soaring over 900% amid Bitcoin's ($BTC.X)own recent surge of more than 10%.

BTC Digital’s shares, previously traded under the name Meten Holding Group ($METX), have gained 283% so far in 2024, outpacing Bitcoin’s rise of 99.10% this year. However, shares are still down over 99% from their 2020 highs.

BTC Digital also announced new hosting agreements on Wednesday to manage 1,100 Bitcoin mining machines for two Asian clients, Recte Technologies Company Limited and ASIA INVESTMENT FUND SP2.

These agreements will see BTC Digital deploying and managing the ANTMINER T21 and ANTMINER L7 machines in the U.S.

Both clients—a digital asset advisory firm and a cryptocurrency mining fund—have also shown interest in potential future purchases, according to the company.

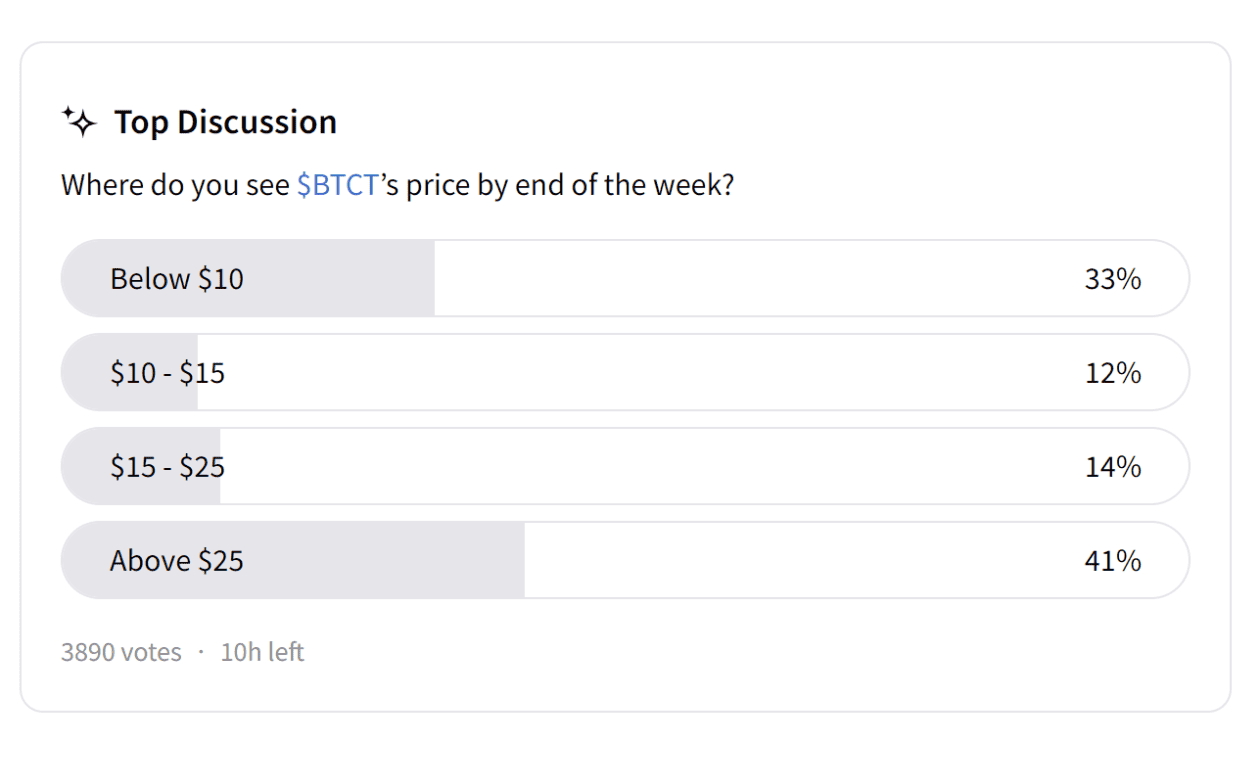

Retail investors on Stocktwits are divided on whether the stock will continue its rally and cross $25 or reverse the trend and end up below $10.

Many users on the platform believe that Chinese stocks like BTC Digital, Autozi, MDJM Ltd. ($MDJH), Kiaxin Auto Holdings ($KXIN), and FOXO Technologies Inc. ($FOXO) are set to surge as they gain institutional interest.

Others have suggested that the recent price rally could be linked to Trump’s win and Bitcoin’s recent bull run.

However, the delayed rise in shares following these events makes the link unclear, leaving traders to speculate on the reasoning and rely on technicals and momentum to guide them in the stock.

With activity levels on Stocktwits spiking sharply this week, this name will likely remain on retail’s radar through the coming days and weeks as retail awaits more news.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)