Advertisement|Remove ads.

Buffett Favorite Sirius XM Stock Snags Bullish Upgrade On ‘Recession-Resistant’ Credentials, But Retail Isn’t Convinced Yet

New York-based broadcasting company Sirius XM Holdings, Inc.’s (SIRI) shares broke below the $20 psychological threshold for the first time in about 13 years following the tariff-induced broader market sell-off.

However, analysts at Seaport Research think the stock is among the recession-resistant bets amid the tariff regime.

Seaport upgraded Sirius XM to ‘Buy’ from ‘Neutral’ and assigned a $27 price target for the stock, The Fly reported. The brokerage said the company is a “recession-resistant port in the tariff storm.”

Analysts at the firm said the company’s recurring revenue is all derived from the U.S. and it has a “sticky” subscriber base.

The company may also be relatively immune to a slowdown in ad spending. Seaport noted that merely 20% of its revenue is from advertising. According to the firm, advertising could turn into a long-term growth opportunity due to investments in the company’s bi-directional satellite radio and podcast initiative.

In late January, Sirius XM reported above-consensus earnings and revenue for the fourth quarter and issued 2025 revenue guidance that aligned with Street estimates.

Sirius XM is among billionaire investor Warren Buffett’s favorite stock holding. Berkshire Hathaway has been amassing Sirius XM stock, and with the last reported addition of 2.31 million shares in early February, the Buffett-led company’s stake in the broadcasting company has gone up to 35.3%.

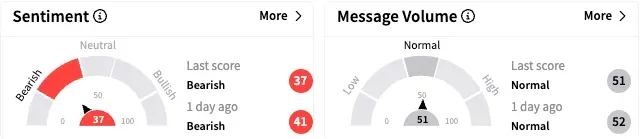

On Stocktwits, retail sentiment toward Sirius XM stock remained ‘bearish’ (37/100) and the message volume continued to be ‘normal.’

A bearish watcher predicted that the stock could move to the $15 level amid the market mayhem.

Another user countered Seaport’s logic. They expect the company to lose subscriptions even if it may not be directly impacted by tariffs.

Sirius XM stock has lost over 14% this year. The Koyfin-compiled analysts’ price target for the stock is $23.96, implying a 24% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Stock Continues To Wilt Under US-China Trade War Heat, Retail Bears Keep Growling

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)