Advertisement|Remove ads.

Sirius XM Stock Rises After Warren Buffett’s Berkshire Hathaway Hikes Stake In Company: Retail Sentiment Hits 7-Month High

Shares of Sirius XM Holdings, Inc. (SIRI) rose early Tuesday as Warren Buffett-led Berkshire Hathaway, Inc. (BRK-A) (BRK-B) disclosed in a late Monday SEC filing that it has increased its stake in the New York-based broadcasting company.

In Form 4 filed with the SEC, Berkshire said it bought 2.31 million Sirius XM shares in four tranches between Jan. 30 and Feb. 3. The total value of the shares purchased was $53.96 million, and the average transaction price is $23.38 apiece.

Following the most recent transaction, Berkshire held 119.78 million Sirius XM shares or about 35.3% stake (based on 339 million in outstanding basic shares).

Berkshire first invested in Liberty Media’s tracking stock in 2016 and began amassing Sirius XM’s tracking stock in early 2024 as an arbitrage play, Barron’s reported. At that time, Liberty Sirius’ stock was trading at a discount to the value of its stake in Sirius XM.

In Sept. 2024, Liberty Media combined the Sirius XM tracking stock with Sirius XM and the consolidated company began to trade as a public company under the Sirius XM brand.

Berkshire has been beefing up its stake in Sirius XM stock since then.

On Thursday, Sirius XM reported fourth-quarter results that topped Wall Street estimates and issued an in-line guidance, sending the stock up nearly 4%.

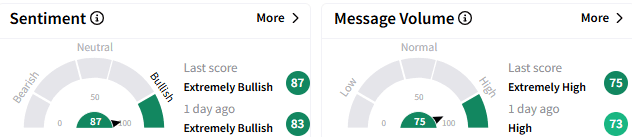

On Stocktwits, retail sentiment toward Sirius XM stock climbed further into the ‘extremely bullish’ (87/100) territory, hitting a seven-month high. The move was accompanied by ‘high’ message volume.

Some stock watchers see Berkshire’s buy positively impacting the stock and flagged a likely break above $30. Another said they would add heavily, eyeing an upside target of $41.50.

Amid the recent momentum, Sirius XM stock has gained 5.3% this year, although it slumped over 57% in 2024 due to the company’s weak advertising revenue and lackluster subscriber numbers.

The stock was up 1.02% at $24.25 by late-morning trading on Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Spotify Stock Set To Open At New Record On Strong Q4 Performance: Retail Positions For Further Gains

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)