Advertisement|Remove ads.

Buy Call On Delhivery: SEBI RA Cites Bullish Momentum, Swing Trade Setup Near ₹395

Delhivery shares rose nearly 2% in early trade on Wednesday, after brokerage firm Motilal Oswal initiated coverage with a ‘Buy’ rating and a target price of ₹480 per share, implying a 17% potential upside. They believe that Delhivery's focus on strategic acquisitions and providing integrated solutions will further strengthen its growth prospects.

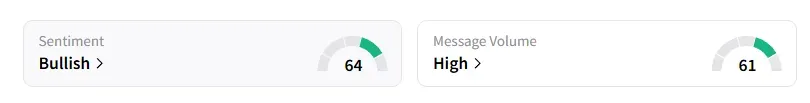

Delhivery has rallied 65% in the last three months. And data on Stocktwits shows that retail sentiment turned ‘bullish’ on this counter from ‘neutral a week ago amid ‘high’ message volumes.

SEBI-registered analyst Financial Independence noted that the stock has continued its stellar run after breaking out to fresh highs with strong volumes. Delhivery has been making higher highs and higher lows, indicating a robust uptrend, they added.

The technical chart shows a clear bullish structure with strong momentum. Its Relative Strength Index is above 70, reflecting strength but nearing overbought territory. Financial Independence believes that we could see a pause or mild pullback before further upside. The volume buildup supports breakout, indicating active accumulation during the previous consolidation.

According to them, a decisive close above ₹420 could open the path toward ₹440–₹455 in the short term, adding that the support level now shifts to the ₹385–₹390 zone. They see a swing trade opportunity with entries on a dip near ₹395–₹400 and a stop loss below ₹380 for a reward-favoring setup.

MOSL Bullish On Delhivery

The brokerage firm anticipates EBITDA margins to improve from 4.2% in FY25 to 7% in FY28, supported by a better cost structure in express and improved margins in the PTL business. Considering the strong focus on volume growth, cost reduction, and enhanced service offerings, they believe Delhivery is well-positioned to capitalize on the growth opportunities unfolding in the express logistics sector.

They have also flagged slower growth in the e-commerce segment and slower-than-expected penetration in the B2B express market as key risks to monitor for Delhivery.

Delhivery shares have risen 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)