Advertisement|Remove ads.

CAE Stock Slips After RBC Capital Downgrade On Lack Of Catalysts: Retail’s Split

CAE’s U.S. shares (CAE) fell 4.6% on Wednesday, tracking a fall in Toronto-listed shares, which RBC Capital downgraded to “Sector Perform” from “Outperform.”

According to TheFly, the brokerage also trimmed the price target for the stock to C$38 from C$41.

RBC Capital analysts said the aircraft simulator maker’s shares are trading at the most expensive level in the sector, appropriately reflecting the solid long-term trends in pilot training and defense spending at current levels.

The brokerage also noted that the stock has fewer positive drivers following an "impressive turnaround" in CAE's defense segment and some near-term macro headwinds that will weigh on its Civil segment results.

Last week, Jefferies said that the company’s Civil segment will face a "destocking" tied to early simulator shipments due to delayed aircraft and a sluggish U.S. hiring environment.

Supply chain delays and production problems have delayed new aircraft deliveries over the past few years. Additionally, several U.S. carriers curtailed capacity in the second quarter due to a slowdown in demand amid uncertain tariff policies.

During the fiscal fourth quarter, the company reported an average training center utilization of 75%, down from 78% in the prior year.

“We expect modestly lower simulator deliveries this fiscal year with a greater proportion occurring in the second half,” the company had said in May.

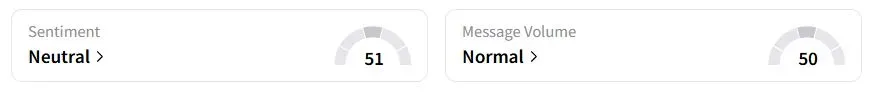

Retail sentiment on Stocktwits was in the ‘neutral’ (51/100) territory, while retail chatter was ‘normal.’

CAE stock has fallen 2.5% year to date (YTD).

(1 Canadian dollar= $0.72)

Also See: Pitney Bowes Stock Jumps After Naming Activist Investor Hestia’s Kurt Wolf As CEO, Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_corning_HQ_resized_jpg_cd127e7be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amd_jpg_c1e6ad7ae9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AI_chip_representative_image_jpg_ab73461e0d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_home_depot_resized_jpg_41f1dc8f5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260490321_1_jpg_e83ecbf5cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)