Advertisement|Remove ads.

Caleres Draws ‘Less Risk’ Rating From Telsey, Retail Chatter Surges 700%

Telsey Advisory Group maintained a ‘Less Risk’ rating on Caleres (CAL) after its quarterly results, stating that even as the broader footwear market remained challenged in the second quarter, the company was able to gain market share in several segments, like women's fashion and shoe chains.

Dana Telsey of Telsey Advisory Group noted that tariffs weighed on the second quarter's margin and are expected to continue impacting the rest of the year. She added that sales declined due to continued pressure on value-priced brands and order cancellations linked to manufacturing in China.

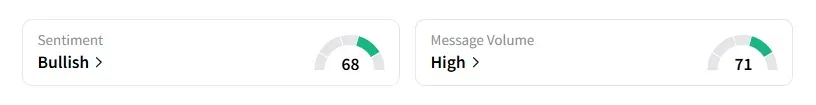

Retail sentiment on Caleres remained unchanged in the ‘bullish’ territory, with message volumes at ‘high’ levels, according to data from Stocktwits. The retail user message count on the stock increased by 700% on Stocktwits over the last 24 hours, as of Friday morning.

Caleres reported second-quarter net sales of $658.5 million, compared with estimates of $656.5 million, according to data from Fiscal AI. Its adjusted earnings per share of $0.35 missed expectations of $0.56. Shares of the company were up 10% during midday trading on Friday.

The brokerage noted that the continued suspension of annual guidance speaks to the challenging operating environment and makes visibility to the earnings potential in the shorter term more challenging.

Caleres acquired Stuart Weitzman from Tapestry for $120.2 million, aiming to add a storied name in luxury footwear to its diverse brand portfolio.

“The acquisition of Stuart Weitzman brings a quality brand name to the Brand Portfolio business that can add to the topline and future profitability potential, and we believe the brand can benefit from a true footwear pure-play owner,” Dana Telsey added.

Caleres' shares have lost over 32% of their value this year and declined nearly 60% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Safe & Green’s Olenox Hits 3,000-Barrel Milestone Post-Texas Acquisition, Retail Chatter Surges 850%

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)