Advertisement|Remove ads.

Can UnitedHealth Steady Investor Nerves As Weak Profit Estimates Meet A Critical 2026 Outlook?

- Wall Street expects lower quarterly earnings even as revenue is projected to edge higher.

- Investors are watching management commentary on ACA rebates, Medicare Advantage exposure, and margin trends.

- Policy developments and progress on Optum integration remain key areas of attention ahead of guidance.

UnitedHealth Group is set to report full-year 2025 results on Tuesday, as Wall Street seeks clarity on its 2026 outlook, the path to margin recovery, and the payoff from its sweeping business reset. The stock closed up nearly 2% on Thursday before slipping 0.3% in after-hours trading.

Wall Street Braces For An Earnings Dip

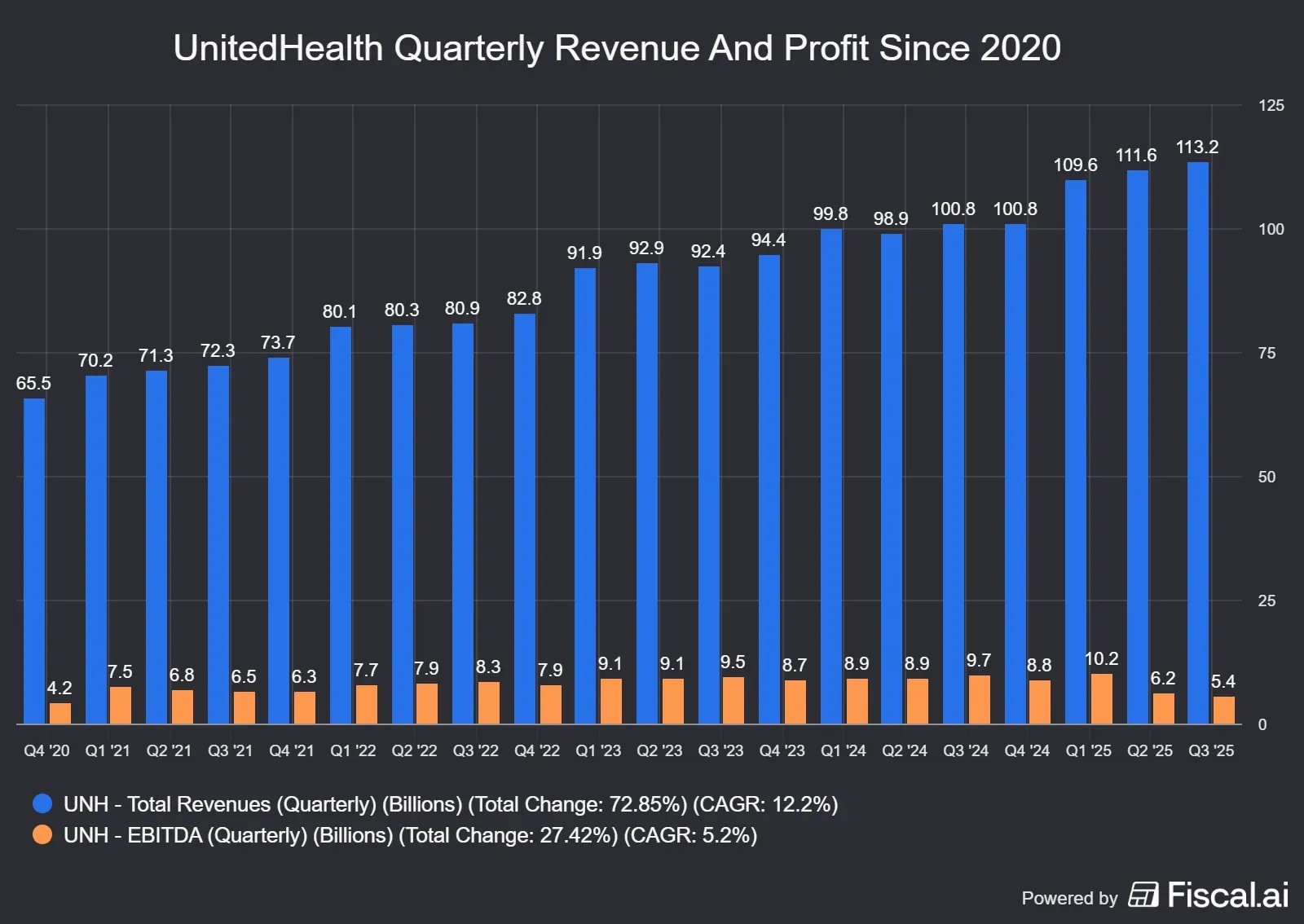

According to Koyfin estimates, UnitedHealth is expected to post modest revenue growth alongside weaker profitability. Quarterly revenue is projected at $113.73 billion, compared with $113.16 billion in the prior quarter. Earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to fall to $4.41 billion from $5.41 billion previously, while earnings before interest and taxes (EBIT) are estimated at $3.29 billion versus $4.32 billion earlier.

GAAP earnings per share are expected at $1.73, down from $2.59 in the prior quarter, while adjusted EPS is seen at $2.11 compared with $2.92 previously.

Koyfin data shows UnitedHealth’s 12-month average price target at $393.85, implying an upside of 11% from its last close. Targets range from $280 to $444. The stock carries a ‘Buy’ consensus, with six ‘Strong Buy’, 14 ‘Buy’, six ‘Hold’, and two ‘Sell’ ratings.

ACA Rebate Decision In Focus

Earlier this week, CEO Stephen Hemsley said UnitedHealth will rebate profits from its Affordable Care Act plans in 2026, as Congress debates extending enhanced premium tax credits.

The House has already approved a three-year extension, though the bill awaits Senate consideration amid opposition from U.S. President Donald Trump. UnitedHealth has said its ACA exposure is limited, with the company previously describing margins in the segment as low single-digit. The company has raised ACA premiums by an average of 25% for 2026.

Baird called the rebate plan a “potentially masterful move,” noting the ACA business is immaterial for UnitedHealth in 2026 and could pressure competitors more reliant on exchange profits.

Margin Recovery Strategy

UnitedHealth outlined its three-year plan to return to profitability during its November investor conference. CFO Wayne DeVeydt said the company will exit money-losing Medicare Advantage and ACA businesses, integrate Optum at the right pace, and use pricing discipline to turn its business around.

The company expects to lose around 1 million MA members as part of its plans to exit lower-return products. UnitedHealth projected a 10% medical cost trend for 2026, up from 7.5%, and anticipates margins in Medicare Advantage will rise modestly with an estimated 50-basis-point increase followed by additional margin expansion into 2027.

Asset sales are expected to be completed by mid-2026. The company also expects to lower leverage, restart share repurchases by H2 2026, and continue growing the dividend.

Regulatory Watch Intensifies

UnitedHealth continues to face scrutiny related to Medicare Advantage risk-adjustment practices. Earlier this month, a Senate Judiciary Committee report cited concerns about diagnostic practices that led to higher federal payments, based on a review of internal company documents. The company said it disagrees with the report and maintained that it complies with Medicare requirements, The Wall Street Journal noted.

At the same time, analysts have pointed to potential policy relief. Cantor Fitzgerald said the Trump administration’s proposed “Great Healthcare Plan,” which focuses on lowering prescription drug prices, increasing price transparency, and reducing insurance premiums, could remove a key overhang for insurers. Wells Fargo said the lack of new onerous provisions in the proposal may be viewed positively by the sector.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for UnitedHealth was ‘bullish’ amid ‘high’ message volume.

One user said, “Tomorrow should be interesting… 3 days of super green, may close in red with Health insurance CEOs grilled on high costs of care in back-to-back house hearings.”

Another user expects the stock to move toward $380 next week ahead of earnings.

UnitedHealth’s stock has declined 30% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)