Advertisement|Remove ads.

Canada Goose Soars 15% As TD Cowen Upgrades Stock To ‘Buy’ On Year-Round Product Strategy

NYSE-listed shares of Canada Goose (GOOS) jumped nearly 15% during midday trading on Monday after brokerage TD Cowen upgraded it to ‘Buy’ from ‘Hold’, citing that the company’s efforts to offer non-winter categories as well are helping growth.

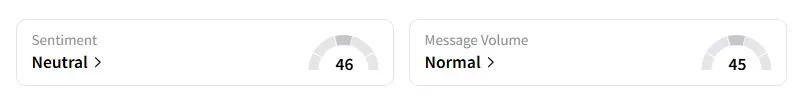

TD Cowen raised its price target to $18, from $16, according to TheFly. The firm cited the company's transition from a classic to a year-round lifestyle outerwear product as the reason for the upgrade. Retail sentiment on Canada Goose improved to ‘neutral’ from ‘bearish’ territory a day ago, with message volumes at a ‘normal’ level, according to data from Stocktwits.

Canada Goose has been offering products that include rain and warm-weather clothing, such as fleece, t-shirts, and shorts. The company is well-known for its winter wear, such as the red parka.

TD Cowen said that it likes Canada Goose's modernization of its product, believing the company is offering a "new and more culturally relevant creative vision." Canada Goose's evolution should drive upside to sales and margins while a potential buyout offers downside protection, the firm said.

In late August, media reports noted that Canada Goose's controlling shareholder, Bain Capital, had received bids to take the company private, valuing it at around $1.4 billion. CNBC reported that Bain had received verbal offers from Boyu Capital and Advent International.

A bullish user on Stocktwits noted that a buyout was imminent and the company would fetch a reasonable price.

Shares of Canada Goose have gained nearly 53% this year and have jumped over 47% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Norwegian Cruise Stock Dips On Share Offering, Stifel Sees Buying Opportunity

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)