Advertisement|Remove ads.

Canadian Pacific Kansas City Lowers Full-Year Profit View On Tariff Hit, CEO Sees More Canada-Mexico Trade — Retail’s Bearish

Canadian Pacific Kansas City (CP) garnered some retail attention on Thursday after it lowered its 2025 revenue growth outlook due to uncertainty caused by President Donald Trump's tariffs.

The railroad operator cut its adjusted earnings per share growth expectations for 2025 to between 10% and 14% from between 12% and 18%, projected earlier.

Headquartered in Calgary, Alberta, the company connects Canada, the United States, and Mexico through railroads stretching 20,000 miles, which makes it vulnerable to any tariff-related demand shocks.

“We remain focused on controlling what we can control, however, the increasing uncertainty created by evolving trade policies and the heightened risk of economic recession make it prudent to amend our 2025 earnings guidance at this time,” CEO Keith Creel said.

Its first-quarter adjusted earnings of C$1.06 per share topped estimates of C$1.05 per share, according to FinChat data.

The company said its first-quarter earnings were driven by strength in its grain portfolio, coal, potash, and intermodal shipments.

“We're seeing opportunities with new trade flows between Canada and Mexico. We've got increased refined fuels, LPGs, plastics, and grains that our customers in Canada are sending south as they look to diversify their end markets,” Creel added in a call with analysts.

The company also expects lower steel demand due to the 25% tariffs imposed by Donald Trump on imports.

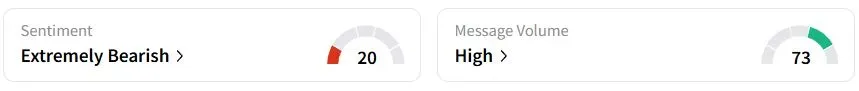

Retail sentiment on Stocktwits remained ‘extremely bearish’ (20/100) territory, while retail chatter was ‘high.'

CPKC stock has fallen 8% year-to-date (YTD).

Also See: MetLife Stock Falls Premarket After Q1 Profit Miss On Investment Income Dip, Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)