Advertisement|Remove ads.

Candel Therapeutics Stock Jumps On Upbeat Q1 Earnings: Retail Gets More Bullish

Shares of Candel Therapeutics, Inc. (CADL) surged nearly 10% on Tuesday afternoon after the company reported upbeat first-quarter (Q1) earnings.

The company reported diluted net income per share of $0.13 for the three months through the end of March, compared to a loss of $0.28 in the corresponding period of 2024, and surpassing an estimated loss of $0.35 per share, as per Finchat data.

It said the rise in net income was primarily related to the change in the fair value of the company’s warrant liability.

While research and development expenses narrowed year-on-year in the quarter, general and administrative expenses rose.

The biopharmaceutical company ended the first quarter with cash and cash equivalents of $92.2 million compared to $102.7 million as of Dec. 31, 2024. Candel expects that its existing cash and cash equivalents will be sufficient to fund its current operating plan into the first quarter of 2027.

CEO Paul-Peter Tak said that the company’s primary focus for 2025 remains working toward submitting an application to the U.S. Food and Drug Administration (FDA) for the commercialisation of its investigational immunotherapy candidate and lead asset CAN-2409 for the treatment of prostate cancer. The submission is expected in the fourth quarter of 2026.

“We are now focusing on executing strategic preparations for potential commercialization, to ensure that, if approved, CAN-2409 is immediately available to patients with localized prostate cancer,” he said.

CAN-2409 is also being studied for the treatment of pancreatic cancer and non-small cell lung cancer.

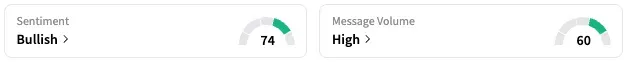

On Stocktwits, retail sentiment around Candel rose within the ‘bullish’ territory over the past 24 hours while message volume jumped from ‘normal’ to ‘high’ levels.

CADL stock is down by about 39% this year and 46% over the past 12 months.

Also See: AMD, Google, Uber Stocks Rally After Committing To Invest $80B As Part Of US-Saudi $600B Trade Pact

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)