Advertisement|Remove ads.

Why This Cannabis Firm Is Among The Top Trending On Stocktwits Today

Cannabis firm Canopy Growth Corporation was among the top trending stocks on Stocktwits on Friday after the company failed to meet first-quarter earnings estimates.

The company reported an earnings loss of C$1.63 compared to an estimated loss of C$0.46 while revenue came in 13% lower on a year-over-year (YoY) basis at C$66.21 million versus an estimate of C$70.1 million.

The firm’s net loss widened to C$127.14 million during the quarter compared to a net loss of C$38.12 million in the same quarter a year ago.

On the positive side, the company said it has entered into an amendment to its credit agreement with all of the lenders to its senior secured term loan. According to the new agreement, the firm will see significant deleveraging of up to US$200 million.

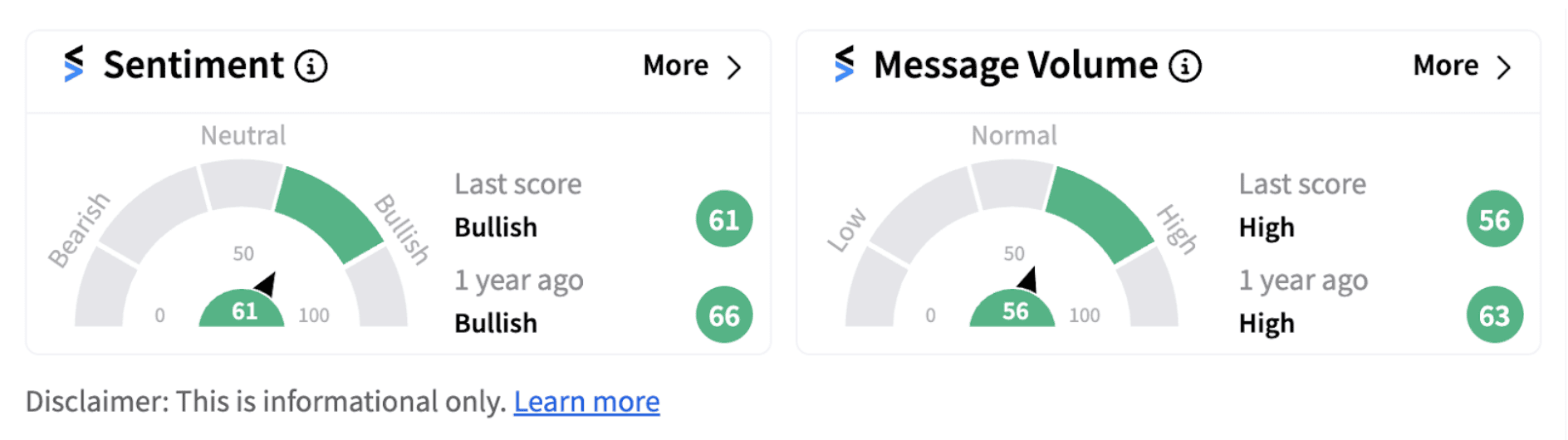

Following the announcement, retail sentiment continued to trend in the ‘bullish territory’ (61/100) although the score inched-down a bit compared to Thursday.

Judy Hong, Chief Financial Officer of Canopy Growth Corporation said the firm’s strategic initiatives have led to notable improvements in gross margins and adjusted operating profit as well as reduction in selling, general and administrative (SG&A) expenses. “We are pleased that all of our business units delivered positive Adjusted EBITDA during Q1 Fiscal 2025 and expect to achieve positive Adjusted EBITDA on a consolidated basis in the second half of the fiscal year,” Hong said.

On a segmental basis, Canada cannabis net revenue came in at C$38MM in Q1FY2025, registering a decrease of 6% YoY. At the same time, international markets cannabis net revenue declined 1%.

The firm also posted a deal update with Canopy USA closing the acquisitions of approximately 75% of the shares of Lemurian, Inc. and two of three Wana entities — Wana Wellness, LLC and The CIMA Group.

Stocktwits users are expressing optimism after the earnings announcement and are bullish on the firm’s prospects following the balance sheet restructuring.

Additionally, comments from Republican presidential nominee Donald Trump on Monday suggested a looser policy stance toward Cannabis could be coming, which helped buoy sentiment toward the overall sector.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hut8_logo_resized_dd54f54415.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)