Advertisement|Remove ads.

Cantor Fitzgerald, Morgan Stanley Back Bullish Stance On Tesla: Retail’s Positive

Cantor Fitzgerald on Monday reiterated its ‘bullish’ stance on EV giant Tesla Inc. (TSLA) and flagged several near-term potential catalysts for the stock, including the imminent launch of its robotaxi network in Texas.

The brokerage has an ‘Overweight’ rating on the stock and a $355 price target, as per TheFly. Cantor Fitzgerald's price target implies a 1.4% upside to the stock’s closing price on Friday.

Fitzgerald told investors in a note that it is encouraged by the management’s reaffirmation of the launch of its robotaxis in Austin in June and the introduction of a lower-priced vehicle model in the first half of 2025.

The brokerage said the launch of a cheaper vehicle could be timely, given the likely negative impact on vehicle prices due to tariff implementation and the possible removal of the EV tax credit.

Cantor added that it is "encouraged" by company CEO Elon Musk's commentary that his time as part of the Trump administration’s Department of Government Efficiency will be “significantly reduced" starting this month and added that it believes Tesla is better-positioned to mitigate the impact of Trump’s tariffs.

Morgan Stanley analyst Adam Jonas also reiterated his bullish stance on the EV maker. While investors are struggling to justify Tesla's valuation, Jonas expects “the valuation problem” will only get worse before getting better.

However, as per Jonas, Tesla is more than an auto retailer with its autonomous driving efforts, energy storage business, and more. The analyst opined that valuing Tesla as purely an auto retailer would be akin to valuing Amazon (AMZN) as solely an online retailer or Apple (AAPL) as a seller of glowing rectangles and earbuds.

Morgan Stanley has an ‘Overweight’ rating and a $410 price target on Tesla. The firm noted that "the majority of the company's current $1.1 trillion market cap is based on businesses that have either poor disclosure, no disclosure, or that have yet to be launched into the commercial market at all."

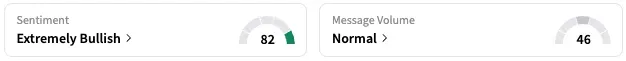

On Stocktwits, retail sentiment around Tesla stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘normal’ levels.

TSLA stock is down by 10% this year but has nearly doubled its value over the past 12 months.

Also See: Super Micro Expands AI Server Line With Nvidia’s Blackwell Chips: Retail Bull Sees Long-Term Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)