Advertisement|Remove ads.

This Utility Stock Is Headed Toward Its Worst Weekly Drop Since 2020 — Analysts See Limited Upside Despite Selloff

- Eversource’s bid to sell its water utility was halted by regulators who voiced concerns over quality of service and cost control.

- Mizuho analysts expected the sale to improve the company’s credit metrics by about 100 basis points.

- Mizuho saw limited upside potential due to regulatory challenges in Connecticut.

Eversource Energy (ES) stock has fallen by more than 13% this week, and if the losses persist, the utility’s shares could be headed for the worst weekly drop since March 2020.

On Wednesday alone, the stock fell 12.8%, the biggest single-day drop since the onset of the COVID-19 pandemic. The selloff came after the Connecticut Public Utilities Regulatory Authority voted to disapprove the firm’s sale of its Aquarion Water Company unit in a $2.4 billion deal.

Why Did Regulators Vote Against The Deal?

Eversource intended to sell the company to the Aquarion Water Authority, a quasi-public corporation and political subdivision of the State of Connecticut, and a standalone, newly created water authority alongside the South Central Connecticut Regional Water Authority. It is expected to generate $1.6 billion in cash and slash debt by $800 million through the sale.

Regulators voiced concerns over quality of service and cost control, according to a Bloomberg News report, as a proposed shift in ownership of the water utility from an investor-owned parent to a nonprofit public system would lead to a decline in regulatory oversight. Additionally, the regulators found Aquarion's rate savings model to be "flawed."

What Did Mizuho Analysts Say?

According to investing.com, Mizuho analysts expected the sale to improve the company’s credit metrics by about 100 basis points. In January, Eversource stated that, with the proceeds, it intended to pay down parent company debt while reinvesting capital in its core electric and natural gas businesses.

Mizuho analysts reportedly expressed concern that the regulatory decision casts doubt on Eversource’s expected Connecticut Light & Power rate filing in the second quarter of 2026, which would seek a 25-30% rate increase during a gubernatorial election. The rejection also likely delayed $980 million in Connecticut storm cost recovery to 2027 or later, worsening the company’s economic recovery.

The brokerage added that Eversource has been on a Baa2 negative outlook at Moody’s since January 2024, and despite the stock trading at a 26% price-to-earnings discount after Wednesday’s rout, Mizuho saw limited upside potential due to regulatory challenges in Connecticut.

What Are Stocktwits Users Thinking?

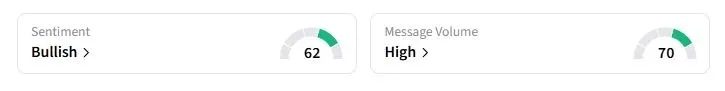

Retail sentiment on Stocktwits about Eversource was still in the ‘bullish’ territory at the time of writing.

Eversource stock has risen 9.8% this year, trailing the nearly 15% gains of the S&P 500 Utilities sector. The company expects to grow its earnings at a compound rate of 5% to 7% through 2029.

Also See: Bessent Disagrees With Musk’s ‘Optional Work’ Future – Says Jobs Will Evolve, Not Vanish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205716060_jpg_b54d4e2d13.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)