Advertisement|Remove ads.

Capital One Stock In Focus After Completing $35B Discover Financial Deal

Capital One Financial (COF) stock garnered retail attention after the company completed its $35 billion buyout of Discover Financial Services.

The merger, which would create the largest credit card firm by loan volume in the U.S., was announced in February last year.

“We are well-positioned to continue our quest to change banking for good for millions of customers,” Capital One CEO Richard Fairbank said.

The two companies' shareholders had voted in favor of the deal in February.

The deal attracted scrutiny from Democratic lawmakers last year on concerns about reduced competition and harm to low-income customers.

In October, New York Attorney General Letitia James had urged a state court to issue subpoenas to Capital One related to an antitrust case on the merger. The two companies have a combined $16 billion in credit card loans in New York.

However, President Donald Trump’s administration has taken a much more favorable stand regarding mergers than the previous Biden administration.

In April, the Federal Reserve and the Office of the Comptroller of the Currency approved the agreement after the U.S. Department of Justice decided not to challenge it.

Capital One’s board expanded to 15 from 12 in connection with the acquisition.

The lender reiterated that it intends to continue to offer Discover credit card products as Discover-branded cards alongside the other consumer cards currently offered by Capital One.

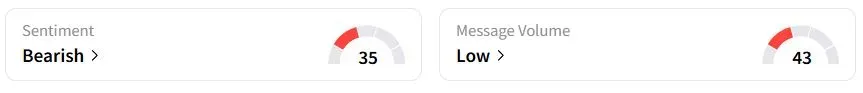

Retail sentiment on Stocktwits was in the ‘bearish’ (35/100) territory on Friday, while retail chatter was ‘low.’

Last week, Capital One reached a $425 million settlement over a lawsuit accusing it of cheating savings account depositors out of much higher interest rates by not advertising them, according to a Reuters report.

Capital One stock has gained 9.6% year to date (YTD).

Also See: Southwest Airlines In Spotlight After US Drops Lawsuit Over Persistently Late Flights

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)