Advertisement|Remove ads.

Capri Holdings Stock Moves Up As Guidance Edges Past Estimates, But Retail’s Not Fully Onboard

Shares of Capri Holdings Limited (CPRI) climbed about 5% on Wednesday after the luxury lifestyle company updated its long-term guidance, though retail sentiment remained subdued.

For 2025, Capri expects total revenue of $4.4 billion, slightly above the consensus estimate of $4.39 billion. This includes $3.0 billion from Michael Kors, $810 million from Versace, and $600 million from Jimmy Choo.

For 2026, the company forecasts $4.1 billion in total revenue, slightly below the $4.18 billion consensus, with contributions of $2.75 billion from Michael Kors, $800 million from Versace, and $550 million from Jimmy Choo.

Capri also projects an adjusted operating margin of 2.3% for 2025, rising to 3.7% in 2026.

“We are optimistic about the long-term growth potential for Versace, Jimmy Choo and Michael Kors as we execute our strategic initiatives,” said John D. Idol, Capri’s chairman and CEO. “Our powerful brands have enduring value and proven resilience, reinforcing our confidence in their ability to deliver revenue and earnings growth over time.”

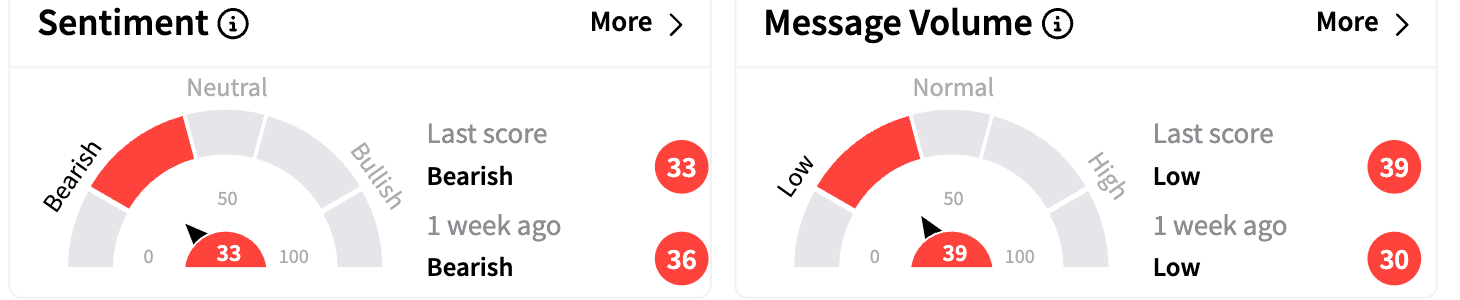

Despite the upbeat outlook, sentiment on Stocktwits remained in the ‘bearish’ zone, with message volume staying in the ‘low’ territory.

However, one bullish user speculated about a potential buyout.

In November, Capri and Coach owner Tapestry Inc. abandoned their $8.5 billion merger plan after a judge sided with the Federal Trade Commission’s opposition to the deal.

Over a week ago, analysts at BofA Securities noted that the health of Capri’s brands had deteriorated. However, they acknowledged that the potential for a recovery from trough sales and margins could provide a counterbalance to their otherwise bleak near-term outlook.

Capri Holdings has seen its stock rise 7.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)