Advertisement|Remove ads.

Capri Holdings Stock Plummets After Q3 Earnings Miss: Retail Sentiment Sours

Shares of Capri Holdings Ltd. ($CPRI) fell more than 10% on Wednesday after the luxury fashion group reported a third-quarter earnings miss, dampening retail sentiment.

Capri Holdings’ adjusted earnings per share came in at $0.45, missing estimates of $0.65. Its revenues fell about 11.6% to $1.26 billion, but were in line with Wall Street estimates.

Capri Holdings sees fiscal 2025 revenue of about $4.4 billion, below consensus estimates of about $4.51 billion, according to Fly.com. It expects FY26 revenue of around $4.1 billion.

"Overall our business remained challenged during the quarter and we were disappointed with our results,” John D. Idol, Capri’s chairman and CEO said. “We are reevaluating our strategic initiatives to improve current sales trends. Looking ahead, we expect our performance to improve throughout fiscal year 2026 positioning us to return to growth in fiscal 2027 and beyond."

"Our portfolio of iconic fashion luxury brands, Versace, Jimmy Choo and Michael Kors, are globally recognized and resonate with consumers. I am optimistic about Capri's future and remain confident in our long-term growth potential."

For Q3, it posted a net loss of $547 million, compared to a net income of $105 million in the prior year. Versace’s revenue of $193 million decreased 15% on both a reported basis and constant currency basis compared to the prior year, the company said Versace was rumored to be a target for a buyout last month.

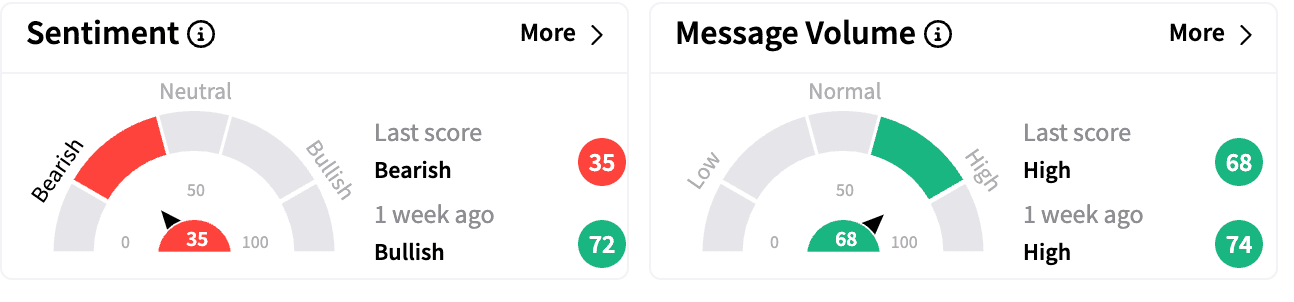

Sentiment on Stocktwits was ‘bearish’ compared to ‘bullish’ a week ago. Message volumes were in the high category.

To be sure, one commenter on the Stocktwits platform saw opportunity in the company’s stock after the dip.

Capri Holdings is a fashion luxury group that owns such brands as Versace, Jimmy Choo and Michael Kors.

Capri Holdings stock is up 2.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)