Advertisement|Remove ads.

Carnival Corp Closes $1B Notes Offering As Part Of Cost-Cutting Strategy — Retail Bulls Smell A Turnaround

Cruise operator Carnival Corp (CCL) said Wednesday it raised $1 billion in debt.

The company issued 5.875% senior unsecured notes due 2031 to investors in a private placement deal.

The proceeds will be used to pay off its $993-million 7.625% senior unsecured notes due 2026, with the redemption scheduled for May 22.

Companies raise debt and roll over existing liabilities on an ongoing basis to refinance at better terms, extend maturities, or manage cash flow without using equity or existing capital.

Carnival said the transaction, along with a prior partial redemption of the 2026 notes, is expected to reduce net interest expenses by more than $20 million through the notes' original maturity.

The debt raise comes as the business shows strong momentum.

In March, the company reported better-than-expected first revenue and raised its profit forecast for the whole year, citing strong demand.

The company said it refinanced $5.5 billion or 20% of its total debt in the first quarter, bringing the figure down to $27 billion from $31 billion in Q1 last year.

Carnival shares are up over 40% since their recent low in April.

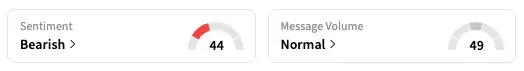

On Stocktwits, the retail sentiment dropped to 'bearish' from 'neutral’ on Wednesday, even as some optimistic chatter emerged on CCL’s stream.

A user said that the company has reduced its debt, and if it could maintain its price-to-equity ratio and business growth, the stock could double over the next few years.

https://stocktwits.com/Obelix60/message/615379246

“Some good news at least,” said another watcher on the latest news that trickled in after the market closed.

https://stocktwits.com/Greatdane11/message/615448734

Carnival stock is down 11.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)