Advertisement|Remove ads.

Carpenter Technology Stock Falls On Profit-Booking; Retail Mood Buoyed After Price-Target Hike

Shares of Carpenter Technology Corp. (CRS) fell 2.8% to $245.95, as investors booked profits on the back of a strong rally this year.

The stock has gained 62% since April and has risen around 45% year-to-date.

According to The Fly, Benchmark raised the firm's price target on Carpenter Technology to $300 from $250 while keeping a ‘Buy’ rating.

The firm pointed to encouraging near-term signals from Boeing (BA) regarding production rates and sustained strength in the aerospace aftermarket and highlighted Carpenter’s strategic position at the start of the aerospace supply chain, which makes it relatively insulated from downstream fluctuations.

The note said that Carpenter is the ‘800-pound gorilla’ in a key segment of aerospace alloys, noting that its $400 million investment in the Athens VIM facility represents the only significant addition to capacity in a market grappling with a long-term structural supply shortage.

Carpenter engages in the manufacturing, fabrication, and distribution of specialty metals.

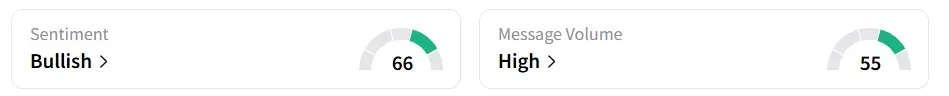

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’, amid ‘high’ message volumes.

One user said the company’s record operating income, booming aerospace demand, and raised FY25 guidance are powering the rally.

Another user believes that Boeing’s delivery backlog will benefit Carpenter Technology.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)