Advertisement|Remove ads.

Carvana Stock Hits All-Time High After Price Target Revisions, But Retail Holds A Bearish Bias

Carvana (CVNA) shares surged nearly 18% on Thursday, hitting an all-time high, after several Wall Street analysts raised their price target on the online used-car retailer, with Citi noting that it was well-positioned to hit its target of selling three million retail units annually within 10 years.

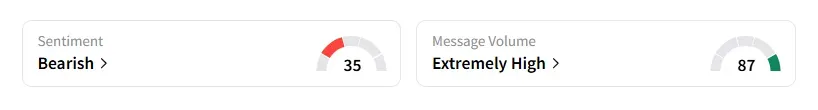

The retail user message count on Carvana stock jumped 1,500% on Stocktwits in the last 24 hours after the quarterly results. Retail sentiment remained in the ‘bearish’ territory, with chatter at ‘extremely high’ levels, according to Stocktwits data.

Retail investor and analyst interest in Carvana has surged recently, driven by renewed momentum in the used-car market as U.S. President Donald Trump’s tariffs have raised concerns over rising prices, with consumers gravitating toward budget-friendly alternatives such as pre-owned vehicles.

Around 10 brokerages raised their price target on Carvana, with Needham raising the most to $500 from $340 and maintaining a ‘Buy’ rating on the stock, according to TheFly.

Wedbush analyst Seth Basham raised the brokerage’s price target on Carvana to $360 from $320 and noted that guidance for the third quarter suggests continued momentum towards long-term growth initiatives.

JPMorgan said that the company's Q2 results were well ahead of expectations, showing the levers it can pull to drive earnings before interest, taxes, depreciation, and amortization (EBITDA) and unit expansion while accelerating share gains. The brokerage raised its price target on Carvana to $415 from $350 and maintained an ‘Overweight’ rating on the shares.

A bearish user on Stocktwits noted that the stock saw a good beat on earnings, but feels way overpriced.

Carvana stock has gained nearly 95% so far this year and jumped over 170% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)