Advertisement|Remove ads.

CCL Products Shares Poised For Breakout: SEBI RA Manish Kushwaha Sees 17% Upside To ₹800

CCL Products, a leading exporter of instant coffee, is witnessing a 16% surge in trade on Tuesday, driven by strong quarterly results.

The company reported strong revenue growth and margin expansion, supported by a favorable product mix and increased off-take in international markets.

SEBI-registered analyst Manish Kushwaha has a bullish view on CCL Products, recommending a buy with a target price of ₹800 — implying a nearly 17% upside from current levels.

He suggests accumulating the stock in the ₹691–₹695 range, with a stop loss at ₹630. He set a target price of ₹800 and advised a stop loss at ₹630.

According to Kushwaha, the stock has historically respected the 38.2% retracement level, which has acted as both resistance and support.

At present, CCL Products is testing the resistance zone near ₹678-a potential breakout area. If the stock manages to break above this resistance with strong trading volume, he believes it could move towards the ₹750–₹800 range.

Kushwaha notes that the Relative Strength Index (RSI) stands at 68.45, indicating that momentum is strong but approaching overbought territory, which is typically above 70.

He also observes notable spikes in trading volume at key turning points, and highlights that the recent rally has been driven by robust volume, suggesting sustained buyer interest.

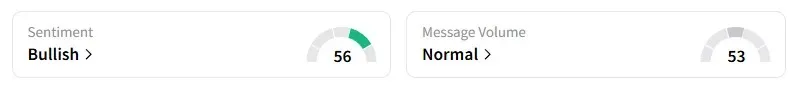

Data on Stocktwits shows that retail sentiment turned ‘bullish’ on the counter from ‘neutral’ a day ago.

CCL Products shares have fallen 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)