Advertisement|Remove ads.

CEA Industries Popped A Whopping 500% This Morning While Retail Chatter Skyrocketed 12,000% On Stocktwits – Find Out More

CEA Industries (VAPE) shares jumped 500% on Monday after the company and 10X Capital, with backing from YZi Labs, stated they are launching a $500 million private investment in public equity (PIPE) deal to build the world’s largest publicly traded treasury company centered on BNB, Binance’s native crypto asset.

Retail user message count on CEA Industries jumped nearly 12,000% in the last 24 hours on Stocktwits.

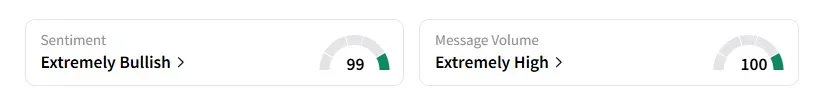

Sentiment on stock improved to ‘extremely bullish,’ compared to ‘bearish’ territory a day ago, with an ‘extremely high’ level of chatter at 100, according to data from Stocktwits.

A bullish user on Stocktwits expects the stock to surge above $100 by afternoon trading.

Shares of CEA Industries surged to $53.35 on Monday morning compared to a close of $8.88 on Friday.

The company stated that the offering comprises a common equity PIPE, which will deliver $500 million in gross proceeds, primarily $400 million in cash and $100 million in cryptocurrency, plus up to $750 million in cash that may be received from the exercise of warrants to be issued in the private placement.

CEA Industries stated that BNB is the fourth-largest cryptocurrency in the world, with a market value of $100 billion, and provides the treasury with opportunities to generate income and rewards on the BNB Chain and Binance ecosystem, which has over 280 million users across more than 180 countries.

The BNB treasury strategy will be led by incoming CEO David Namdar, the co-founder of Galaxy Digital and Senior Partner at 10X Capital, and incoming CIO Russell Read, the former CIO of CalPERS and 10X Capital, the company said.

It added that 10X Capital will serve as the asset manager of the BNB treasury strategy, with the support of YZiLabs, and the transaction is expected to close on or around July 31, 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Abercrombie Stock Gets A Price Target Hike From JPMorgan, But Retail’s Not Celebrating Yet

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)