Advertisement|Remove ads.

Cement Sector On Solid Ground In Q1: SEBI RAs Expect Bullish Momentum Amid Capacity Surge

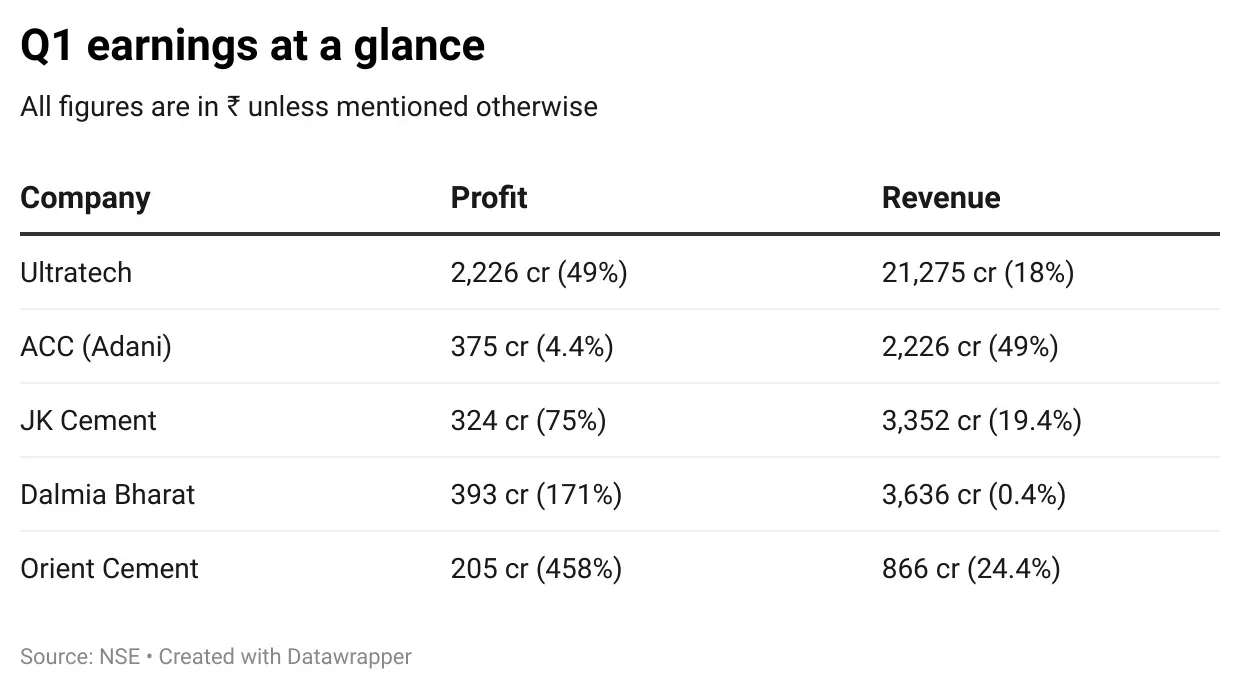

Indian cement companies started fiscal 2026 on a strong note, reporting double-digit growth in profits and revenues for the first quarter, despite price volatility caused by the monsoons. Top players like UltraTech, JK Cement, and Dalmia Bharat posted earnings surprises, supported by strong infrastructure and housing demand.

Domestic brokerage firm ICICI Securities noted that pan-India cement prices rose 3 - 4% sequentially, marking the third consecutive quarter of price gains. This price momentum was reflected in the quarterly results.

Q1FY26 Performance Snapshot

India’s largest cement producer, UltraTech Cement, posted a 49% year-on-year (YoY) rise in consolidated net profit, with revenues rising 17.7%. The integration of India Cements and Kesoram Industries’ cement business contributed to a 9.7% increase in sales volume. During the quarter, the company added 3.5 million tonnes per annum (MTPA) in grey cement capacity, pushing its total installed capacity to 192.26 MTPA.

Adani Group-backed ACC saw its profits being halved sequentially, even as realisation gains helped revenues rise. Its volumes grew to 11.5 million tonnes from 10.2 million tonnes in the first quarter of last year.

JK Cement recorded one of the strongest performances among mid-cap peers, with 15% volume growth in grey cement and revenue gains driven by price recovery in Central and Southern India. In contrast, Dalmia Bharat missed estimates on the bottom line but managed to hold costs. It saw a 5.8% decline in sales volume.

Orient Cement saw strong growth in margins. During the quarter, Ambuja Cements acquired a 26% stake in Orient Cement through an open offer, raising its total shareholding in the company to 72.66%.

Here’s a look at the earnings performance across India’s cement makers for Q1

Yet to report: Ambuja Cements (July 31) Shree Cements (August 4), Ramco Cements (August 13)

Analysts expect capacity expansion to boost sector growth

India’s cement sector remains on a firm footing with leading players reporting solid growth, both in volume and operational performance, despite regional variations in pricing, said SEBI-registered analyst Adarsh Nimborkar.

UltraTech Cement’s EBITDA per ton stood at ₹1,125, supported by tight cost control and its extensive pan-India reach. The company has a robust expansion plan, targeting an additional 22 MTPA capacity by FY27.

Backed by the Adani Group, the combined entity of Ambuja Cements and ACC now commands a 77 MTPA capacity and aims to nearly double it to 140 MTPA by 2028. The company continues to invest in logistics, green fuel transition, and integration boost.

Shree Cement posted an 8% volume growth and the highest EBITDA per ton at ₹1,130, the analyst said. It remains focused on expanding in South India while maintaining stable margins through disciplined cost management.

Dalmia Bharat, with 42 MTPA capacity, emerged as the fastest-growing mid-sized player. It recorded an EBITDA per ton of ₹1,070. The company is targeting 75 MTPA capacity by FY27 and holds a strong position in East and South India.

From a technical viewpoint, the sector outlook remains bullish, with attractive opportunities for long-term accumulation, Nimborkar concluded.

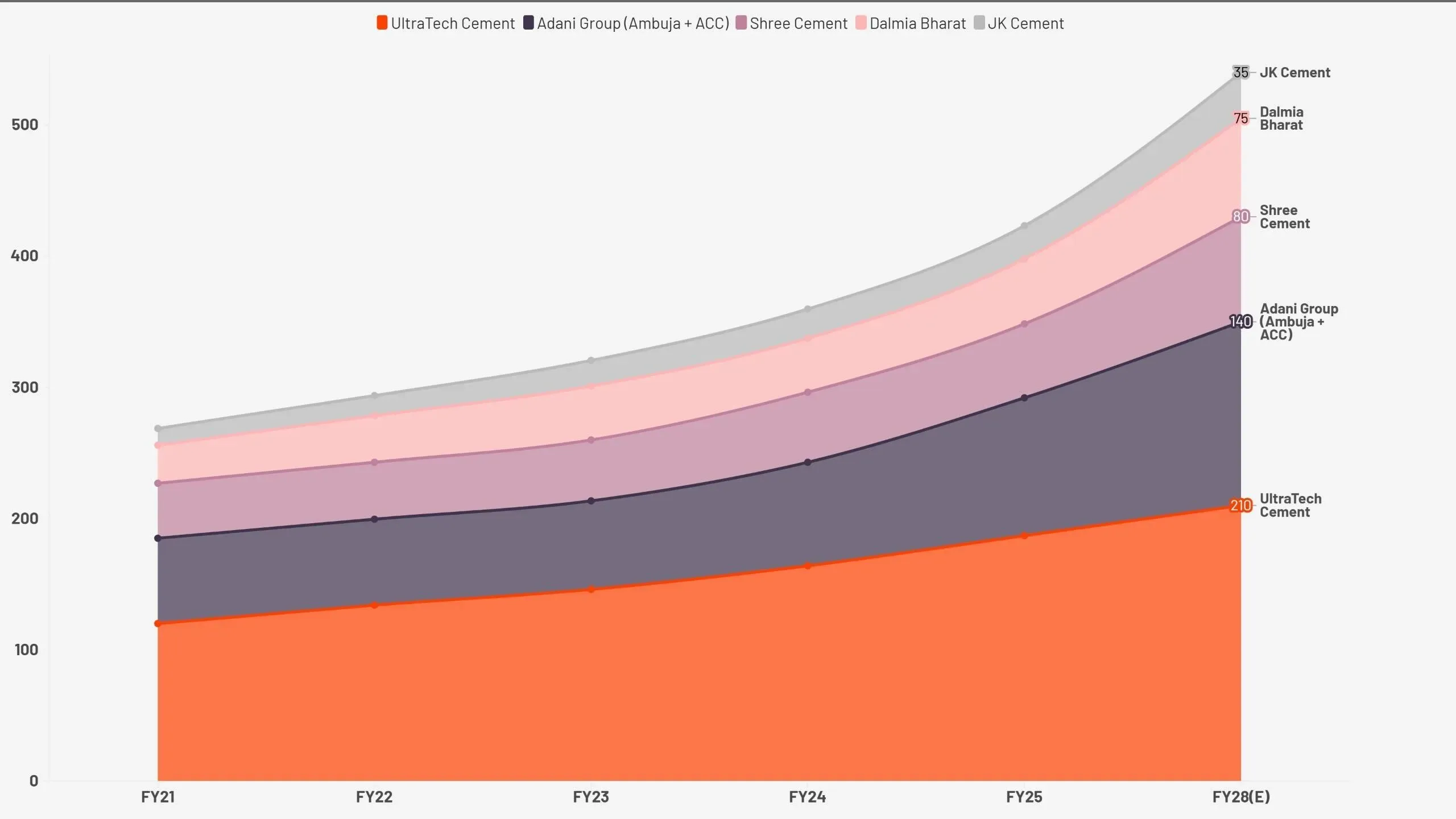

SEBI-registered investment advisors at TrueNorth Capital anticipate that cement makers will aggressively expand capacity to meet overall demand, with the top players targeting significant scale-ups by FY27-FY28.

Capacity ramp-up plans by India’s top cement players

Source: True North Capital

UltraTech: EBITDA/ton at ₹1,125; plans to add 22 MTPA by FY27.

Adani Cement (Ambuja + ACC): 77 MTPA capacity now; targeting 140 MTPA by FY28.

Shree Cement: Highest EBITDA/ton at ₹1,130; targeting 80 MTPA by FY28.

Dalmia Bharat: Fastest-growing midcap; targeting 75 MTPA by FY28.

JK Cement: Investing ₹3,000 crore to expand to 30 MTPA by Q4 FY26.

Early-quarter hikes cushion weak prices in June

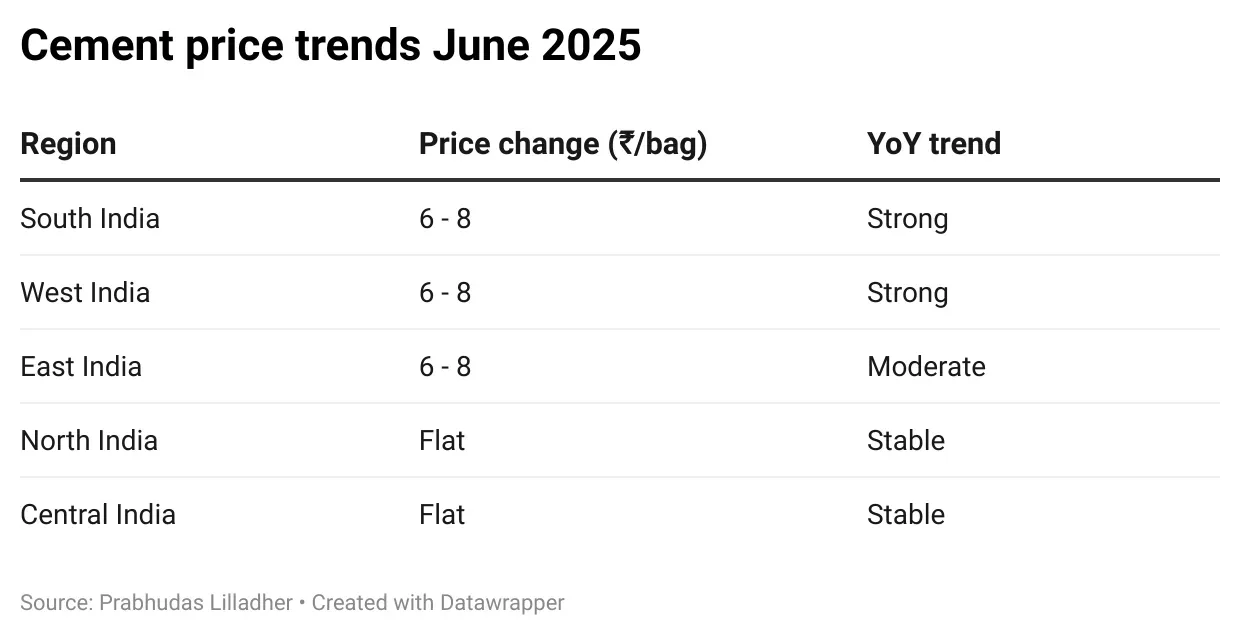

The onset of monsoons disrupted demand momentum, leading to a decline of ₹6 - 8 per bag across the south, west, and east regions in June. Cement prices remained largely flat in north and central India.

Overall, brokerage firm Prabhudas Lilladher noted an average price dip of ₹4 per bag to ₹361 across the nation. While prices may decline further in July, they remain strong on a year-on-year basis, particularly in the South and East, which had witnessed steep hikes earlier in the quarter.

Southern and eastern markets are expected to report robust Q1FY26 earnings, driven by improved pricing and operational efficiencies. Even though demand has softened, the housing (IHB) segment may provide some cushion due to increased interior work during and post monsoons. Further margin support could come from easing pet coke prices, the brokerage added.

Brokerage Corner

ICICI Securities expects a 45% YoY jump in Q1FY26 EBITDA for the sector. With another round of price hikes despite the ongoing monsoon, earnings upgrades are on the table for Q2FY26. It maintained a ‘Buy’ on UltraTech with a revised target price of ₹14,600, adding that firm prices in Q2 could boost FY26 earnings beyond consensus.

Motilal Oswal reiterated a ‘Sell’ rating on India Cements, while cutting its price target to ₹280, citing modest growth. EBITDA per ton is expected to increase from ₹350 in FY26 to ₹760 in FY28.

Nirmal Bang maintained a ‘Hold’ rating for JK Cement while raising the price target to ₹6,231. EBITDA per ton is seen rising from ₹1,167 in FY26 to ₹1,334 in FY27, resulting in estimated savings of ₹150 - ₹200 per ton.

So far in 2025, UltraTech Cement shares have gained over 6%, Dalmia Bharat rose 24%, while JK Cements shares have surged 41% higher. On the other hand, ACC stock declined 11%, and Orient Cement fell 20%

Despite regional challenges, the long-term outlook for the cement sector remains bullish, as capacity expansion, margin tailwinds, and infrastructure spending are expected to sustain momentum.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)